Take Your First Step Towards a Debt-Free Future

- Consolidate multiple payments into one

- Be debt free in 24-48 months

- See what options you qualify for in minutes

Reduce Your Monthly Payments

Consolidation and other options can lower your total monthly payments, and lessen the burden of your debt giving you financial peace of mind.

Your Success is Our #1 Priority

Our fees are 100% success-based – we don’t get paid until we have helped you achieve a solution for your debt.

How Monthly Savings Brought Rosemary Financial Relief

After Rosemary took out loans to repair her home, she found herself in serious debt. Accredited Debt Relief helped her reduce her monthly payments from $2,800 to $678!

Our highly rated debt consolidation options can give you the help you need to achieve a brighter financial future. We’re proud to provide excellent service and quality debt consolidation products to our clients.

Hear More Testimonials From Our Clients

"My consolidation specialist came up with a plan that will save my husband and me nearly $500 a month! He didn't try to 'sell' me anything and was straightforward with all the information. I couldn't be happier with my decision to make that call."

Denise, Trustpilot"I was so glad that the process was quick and easy, and my consolidation specialist was very courteous and professional. He was able to expedite the process to assist me to gain my financial freedom within a reasonable amount of time."

Joseph, Trustpilot"The level of customer service was unmatched. My consolidation specialist showed so much compassion and knowledge with everything we discussed. This service is very valuable, and I appreciate you all for being so kind when people are vulnerable."

Vallery, TrustpilotWe've helped our clients with $1 billion in debt. Are you next?

Individual experiences may vary. Reviews are edited for length, accuracy, and clarity.

Financial Wellness Resources

Most people in debt share a common goal: to pay it off quickly and save as much money as possible. No one wants to spend more than they have to. Fortunately, there are many different ways to get out of debt faster and for less money. Consider six of the cheapest ways to get out of debt and find the solution that is right for you.

Debt consolidation loans are a common method of refinancing that involves paying off high-interest debt with a new lower-interest loan.

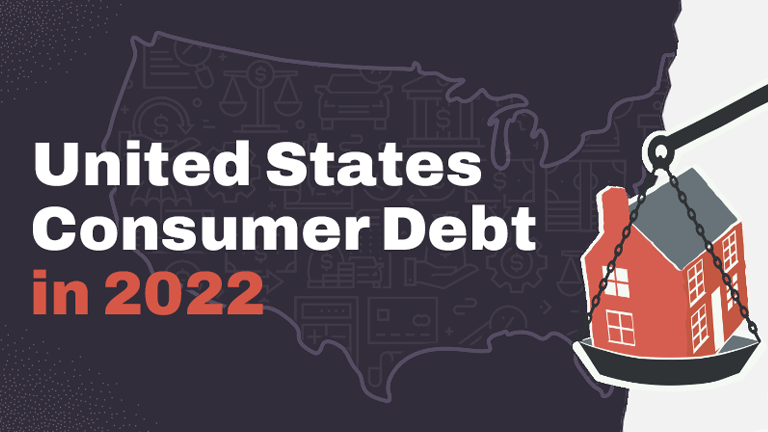

Have debt? You’re not alone. 8 out of 10 Americans reported having some debt in 2020. Debt isn’t inherently bad, in fact, it can be a necessary tool to get an education. It can also help you build your credit and can be useful when you want to finance large purchases. However, the type and amount of your debt make a big difference in assessing your financial health.

Despite significant economic improvement in 2021, consumer debt in the U.S. has once again hit an all time high. By the first quarter of 2022 it climbed to $15.83 trillion – more than double what it was in 2003 and 20.9% higher than the total pre-pandemic.