Driver’s licenses, first jobs, school dances and college searches: your teen years are full of important milestones. They also tend to be more financially focused, with your first big purchases and glimpses of adulthood on the horizon.

Budgeting can help you smartly manage your money and new responsibilities. However, if you’re new to earning money and making monthly payments, it can be hard to know where to start. Here are seven budgeting basics that can help set you up for success in your teen years and beyond.

Understanding Income

Before you can decide what to do with your money, it’s important to understand where it’s coming from and how much you have available. Income might be easier to determine if you have a full-time job with a regular paycheck, but teens and young adults who don’t traditionally have salaried positions or who may not receive a pay stub might have a harder time picturing what’s coming in.

Take the time to think through where your money comes from. Here are some examples:

Income Can Be…

Gross vs. Net Income

Hang on — I’m supposed to earn $10 an hour, and I worked 10 hours this week. Why isn’t my paycheck $100?

An important aspect of income that might surprise you when you get your first paycheck is the difference between gross and net income.

Gross income is the money an employee earns before payroll deductions, like taxes and benefits.

Net income is what remains after deductions are taken. This amount is what the employee actually takes home.

When you’re calculating your budget, make sure you focus on your net income — that’s the number you’ll actually receive and can spend.

Understanding Expenses

While making money is great, bracing yourself for expenses can be a bummer. Making a plan ahead of time for how you’ll spend your money can help you cover the necessities while allowing you to see what’s free to use in more fun ways.

Expenses Can Be…

Income and expenses can change month-to-month. Reviewing your budget regularly can help you have a more accurate picture of where your money is going throughout the year.

Tracking the Cash Flow

Tracking your money with a budget allows you to see how far it’s going and what expenses you regularly pay for. Budgeting can also reveal bad spending habits, allowing you to make adjustments and prioritize what you want to invest in.

It’s hard to keep track of a budget in your head, so it’s a good idea to write it all down. As long as you do it in a way that’s easy to update, there’s no wrong way to record it! You can use an app, write it down on paper or create a spreadsheet.

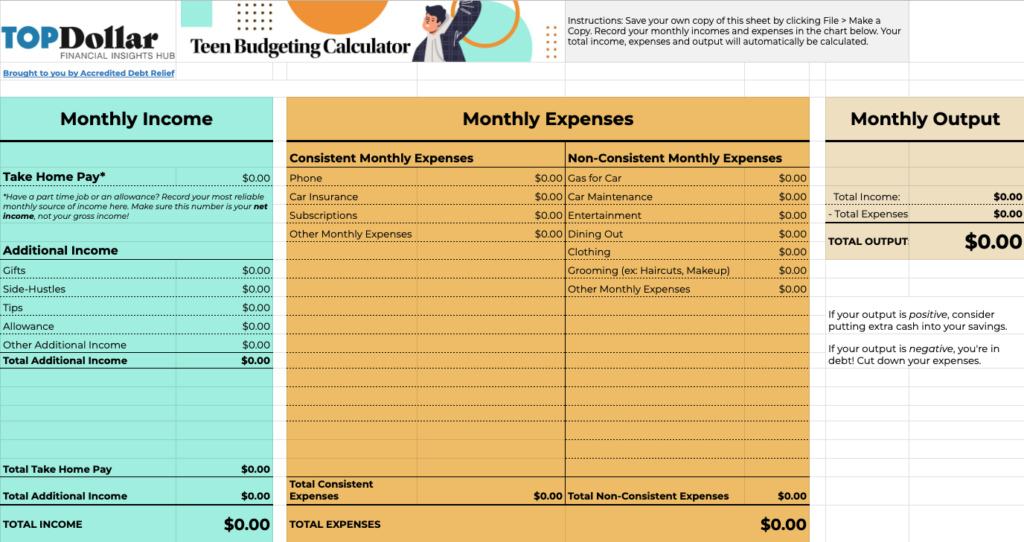

We’ve built a customizable budgeting calculator to help get you started.

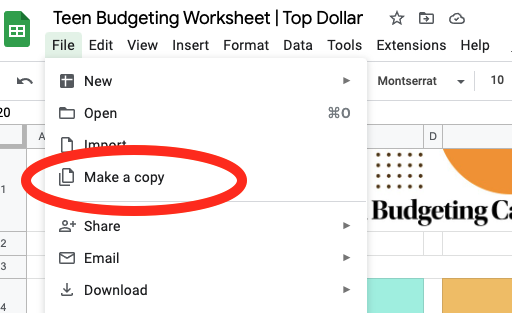

Our copy is locked for editing, but you can save your own version and adjust it to fit your needs. Click “File” and “Make a copy” in the upper left-hand corner to save.

Spend Less Than You Earn

Once you’ve recorded everything in your budget, you’ll be able to calculate your total monthly output:

Income – Expenses = Total Output

Your ultimate goal should be to spend less money than what you receive each month, creating a positive total output. If you have a negative output, you’ve overspent; you may have to borrow money to make ends meet, which puts you in debt.

Some kinds of debt, like borrowing money to go to college, are okay to have if you can pay it back later. However, taking on debt as a teen isn’t a great practice for the future. Breaking even month-to-month isn’t ideal either — if you don’t have anything left over now, you can’t save for big-ticket purchases later.

Creating and Saving for Long-Term Goals

Speaking of bigger purchases, what do you really want to do with your money? Get a new game system? Go to a music festival? Save up for college? Major purchases might require serious saving, but having a long-term goal in mind can motivate you to spend less and save up.

Try adding your savings goal to your budget by treating it like a monthly expense. Commit a set dollar amount or percentage of your monthly income towards your goal. Rather than spending it, stash that money away in a savings account. Breaking an expense down and saving smaller portions of money over time can help you make steady progress to achieving your goal.

Weighing Priorities

Money has limits — it only stretches so far, and you can’t pay for every single thing you might want. Is it a good idea to spend money on those concert tickets if you’re also trying to save up for a new phone? Will buying snacks while out with friends now derail you from buying that new game you want next week?

That’s why it’s important to weigh your options and consider the pros and cons of each purchase before swiping your debit card. You might have to make trade-offs, especially when your budget is tight. However, thinking through your options now can help you avoid making an impulsive purchase you’ll regret later.

Earning More

If your current income isn’t enough to cover your monthly expenses, your options are to make more money or spend less. Side hustles and part-time jobs are a great way to bring more money in, but they do require time and energy.

Before taking on more work, carefully consider your current responsibilities (current job, school, chores) and how much time you currently have to do the things you really enjoy (hanging out with friends, sports, after school activities, etc.). If you have the time to spare and really need the cash, taking on more work might be the way to go.

More Money Advice for Teens and Young Adults

Looking for more personal finance tips? Read more from Top Dollar: