Get to Know Belkys: A Teacher from Texas

Belkys M. has built her life around helping others. Born in the Dominican Republic, she now lives in Texas, where she is a teacher and spends her free time enjoying the beach and being with her family. But for years, she carried a heavy financial burden that kept her up at night: debt.

I found Beyond. I called and the person I talked to was so understanding. It was a relief hearing someone telling me that they can help — that I can pay what I owe and start building an emergency fund.

Debt Amount: $39,538

Started: September 2023

Savings: She saved $420 a month!*

For Belkys, Debt Took Over Her Finances Gradually

“I got into debt gradually,” Belkys explains. “I had to help my mom and husband who had cancer and my salary at the time was not enough to cover all my responsibilities.”

Belkys thought she was doing everything right — working hard, caring for loved ones and trying to make ends meet. But over time, the stress added up to symptoms she couldn’t ignore.

I was so worried all the time and I wasn’t sleeping very well. I started to lose my hair because of the stress. I had to get a second job to help me with paying my credit cards and loans.

A Home AC Repair Was a Wake-up Call

Belkys’ turning point came one day when her home’s air conditioner stopped working. That small but urgent repair highlighted how fragile her finances had become. Even after working two jobs, she didn’t have enough savings for emergencies. Something had to change.

My lightbulb moment was when the AC of my house needed repairs and I didn’t have $300 to pay for the maintenance. That’s when I thought that I needed to do something to get my finances in check.

Her First Conversation With Beyond Finance Was Emotional but Life-Changing

“One day someone mentioned to me about programs that help you with paying your debts and save some money,” Belkys says. “I started Googling and found Beyond. I called and the person I talked to was so understanding and made me feel that I have options.”

That first conversation was emotional — and life-changing.

I remember that night I was so hopeless that I even cried telling the lady how terrible it was that I got paid and didn’t have any money left and still needed to make some payments. It was a relief hearing someone telling me that they can help, that I can still pay what I owe and start building an emergency fund.

For the first time in a long time, Belkys felt hope.

“The best thing is having a set amount of money that I pay monthly and being able to follow a budget,” she says. That structure brought her peace and control — things she hadn’t felt in years.

She also learned “to be patient and trust the process.” Now she advises others to do the same.

It’s hard at the beginning and throughout the first year, but Beyond gets results.

When She’s Debt-Free She Dreams of Traveling the World

Now, with her finances back on track and her stress lifting, Belkys is starting to dream again. When asked what she looks forward to most, her answer is simple and full of joy:

When I’m debt-free I’ll be traveling around the world.

Thanks to her determination — and the support of Beyond Finance — that dream is finally within reach.

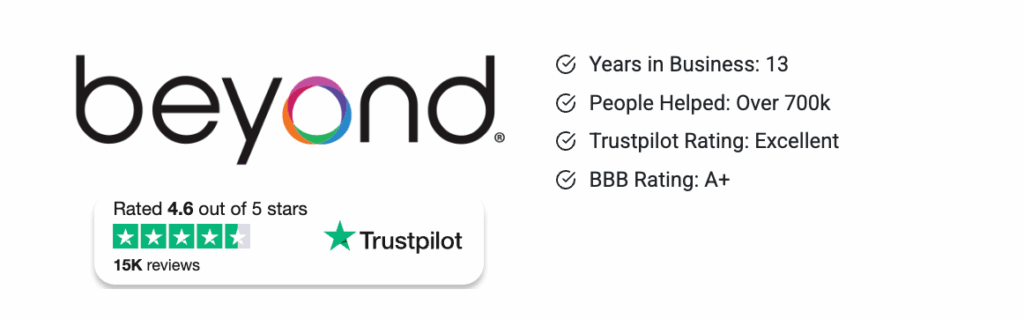

About Beyond Finance

For over 13 years, Beyond Finance has helped more than 1 million people pay off over $3 billion in debt. Their top-rated debt consolidation option is faster and more affordable than alternatives like bankruptcy or making minimum payments.

About This Testimonial

*Belkys is a real client who was compensated for taking the time to share her experience with us. Clients typically save $480 on their monthly payments. Savings were calculated by subtracting her program payment from her self-reported payments or tradeline minimums on eligible accounts.