Military service is demanding and often dangerous. While most folks are familiar with the visible sacrifices — long deployments, high-risk environments, stressful conditions — we know far less about the financial struggles many veterans face on the home front during and after their service.

For many veterans, financial struggles begin during service: frequent relocations, long absences, and deployments can strain a household budget and limit savings. And the challenges don’t end there. Transitioning to civilian life often brings income gaps, medical bills, and delayed benefits — all of which can lead to debt.

If you are a veteran, or know one who’s struggling, these real stories show that recovery is possible and help is available.

An Army Veteran from Texas Who Overcame $45,920

Rose Mary O., an Army veteran from Texas, graduated from Beyond Finance in 2022 after they helped her with more than $45,000 in high-interest debt she’d taken on for an expensive home repair. Despite never missing a payment, she was overwhelmed and was looking at retirement years defined by debt. Now, she’s travelling and enjoying home improvements.

I’m a lot happier because I don’t go to sleep with circular thoughts wondering how I’m going to pay my debt.

Debt Amount: $45,920

Started: February 2019

Graduated: November 2022

Rose Mary’s New Debt-Free Life

Rose Mary celebrated graduation with a month-long trip to Korea. Since then she’s driven 7,000 miles across the U.S. with her son, repaired her historic home, built a $4,000 emergency fund and started a $15,000 savings account for her granddaughter. At nearly 70, she says she’s debt-free, credit cards at zero, and never going back.

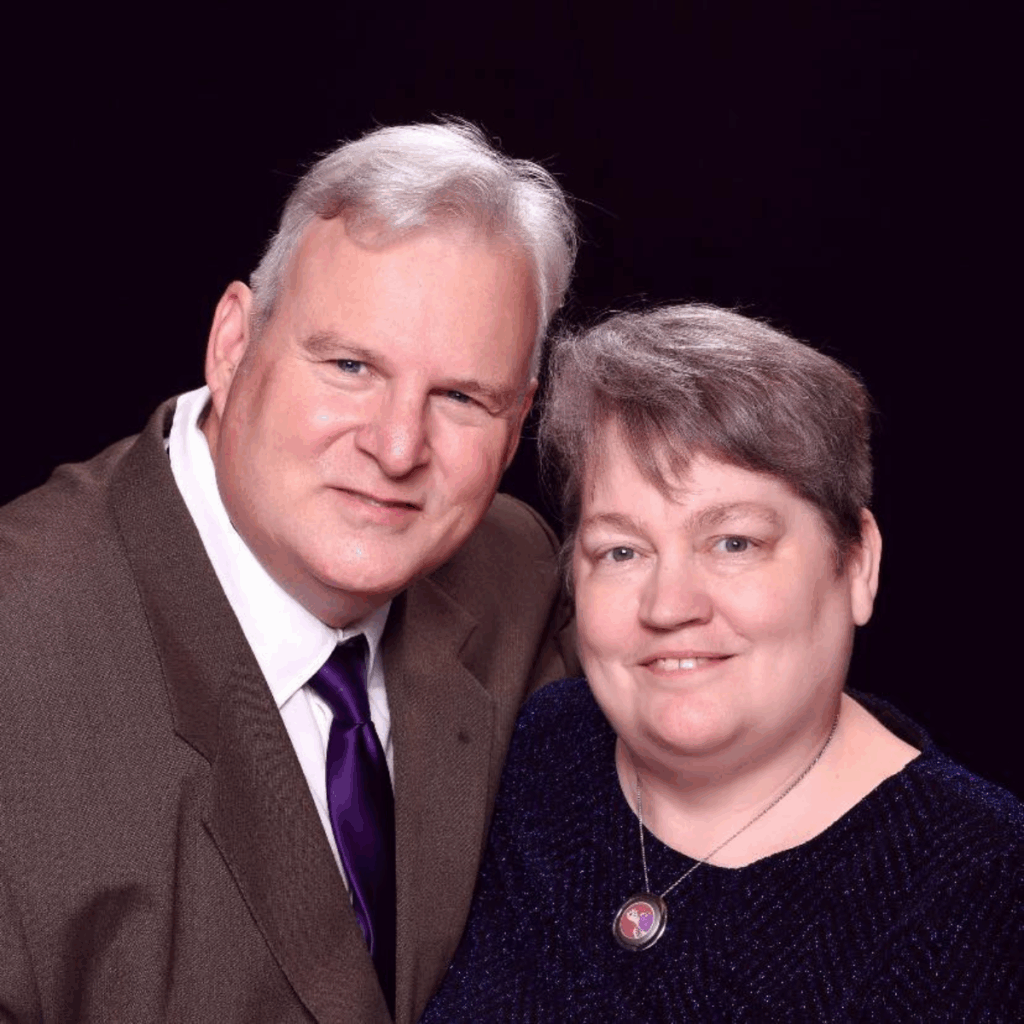

Air Force and Navy Veterans from Oklahoma Who Are Getting Out of $39,828 in Debt

Mark and Dawne M. are disabled veterans who raised four kids and looked forward to retirement in Oklahoma. Then disaster struck: a broken well, storm damage and ruined appliances. With no savings, they turned to credit and ended up in nearly $40,000 of debt.

We went from being able to supply other people with food…to needing the help ourselves. It was hard.

Debt Amount: $39,828

Started: June 2023

Monthly Savings: $518 (66%)*

Life After Enrollment

Beyond Finance cut their monthly payments by more than half, allowing them to afford real groceries again and reduce the strain on their marriage. What once looked like 20+ years of endless interest is now a manageable 48-month plan. Today they’re hopeful, focused on family and eager to show their grandkids that asking for help is strength, not weakness.

Learn more about Mark and Dawne M.

A Navy Veteran from Idaho Who Paid-Off $38,918

John and Lucie W. have known each other since seventh grade and weathered life’s storms together — from running a business to surviving serious illness. When John, a Navy veteran, retired early due to health issues and Lucie faced breast cancer, debt piled up to almost $39,000.

What happened to us — being able to find you to pull us out of that hole — was basically a godsend.

Debt Amount: $38,918

Started: December 2019

Graduated: June 2024

Life After Graduating from Beyond Finance

Beyond Finance lowered John and Lucie’s payments from $1,800 to $500 a month, helping them keep their home. Today, Lucie is still fighting health battles but remains resilient. Together they’ve replaced broken appliances, financed a Jeep Grand Cherokee and are planning a road trip across the South — with a stop at Graceland for Lucie. John looks forward to fishing again with his pup, Dixie Rose.

Learn more about John and Lucie W.

A Navy Veteran from Florida With $10,570 in Debt

Christian S., a former Navy officer, got into debt while using credit cards to cope with the stress of service and college. By the time he graduated, he owed more than $10,000 and was paying $350 a month just in credit card bills.

The military is a high stress job. One of the ways I coped was buying things I wanted, even if it meant debt.

Debt Amount: $10,570

Started: January 2024

Monthly Savings: $202 (53%)*

Life After Starting a Beyond Finance Program

Beyond Finance reduced his payments and gave him peace of mind. Christian, now working in cybersecurity at a private college, is nearly debt-free and focused on saving for a home and a new car.

His advice to fellow service members: “Get on the phone. Just call and see if they can help.”

Finding Your Own Path to Freedom

Debt consolidation options, including loans, can help combine multiple debts into one manageable payment. For veterans and civilians alike, that structure can mean lower monthly costs, a shorter repayment timeline, and less stress overall.

If you’re carrying the weight of debt and wondering what comes next, know this: you don’t have to face it alone. Talking to a Consolidation Specialist at Accredited Debt Relief can help you understand your options and see if programs like Beyond Finance are good for you, your debt and your long term financial goals.

About Beyond Finance

For over 13 years, Beyond Finance has helped more than 700,000 people pay off over $2 billion in debt. Their top-rated debt consolidation option is faster and more affordable than alternatives like bankruptcy or making minimum payments.

About these testimonials

These are real clients who were compensated for taking the time to share their experience with us. Clients typically save $480 on their monthly payments. Monthly savings were calculated by subtracting their program payment from their self-reported payments or tradeline minimums on eligible accounts.