Making smart decisions with your money requires you to juggle multiple financial goals at the same time. That’s why we know that saving for retirement often goes hand in hand with managing your debt. If you are contemplating how to save for retirement when you have credit card debt, this blog will cover many common scenarios to consider when making your decision.

Should I Be Debt Free Before I Retire?

Up to 60% of households over 65 carry debt. So, there is a good chance you may not be completely debt-free when you retire. The important thing to remember is that it’s not the debt itself that is a problem, it’s the type and amount of debt you carry. Your income stability or instability during the years when you should be saving for retirement also plays a big role in how you approach your debt and retirement savings.

How Do You Plan to Save for Retirement?

There are many different ways to save for retirement. The most common involve retirement investment accounts that are linked to your employment. These accounts often involve an incentive called an employer match as well as interest rates that depend on how your money is invested while it is in the retirement account.

Common Ways to Save For Retirement:

- 401k

- Roth IRA

- Home Equity Investments

- Public Retirement Programs

- Social Security

What is a 401k Employer Match?

With a 401k employer match, your employer will put money into your retirement account based on how much you are saving. Matches vary considerably by employer and may include: waiting periods, dollar-for-dollar matching, partial matching, and caps on the amount of money an employer will put into your account.

Can I just put the money in a savings account?

You certainly can do that, however, most savings accounts have very low interest rates so your money isn’t going to grow very much. The key to growing your retirement savings is to put the money in an account that has an interest rate large enough to see significant growth over the 10-40 years that you may save for retirement.

Learn more about other types of retirement savings plans.

Calculate How Much You Need to Retire

According to the latest available data, people of retirement age in the United States, which includes those 65 years of age and older, spend an average of $45,756 a year, or about $3,800 a month. Using these figures as an example, below is a chart showing how much you would save using two common retirement saving models.

The ‘Multiply by 25’ Rule

The ‘multiply by 25’ rule is a fairly straightforward way to calculate your retirement savings. Simply calculate your annual expenses and multiply by 25. Essentially, this method ensures that you will have enough funds in your retirement account to live comfortably for 25 years after retirement.

Let’s say you start saving for retirement at age 25 and will retire at 67. This gives you 42 years to save and invest. Using the 25 rule, you can work backward to calculate how much you need to save annually in order to meet your goal.

Save For Retirement Using the 25 Rule

| Average Annual Expenses | Multiplied by 25 | Average* Monthly Savings for 42 years |

| $45, 756 | $1,143,900 | $2,269 |

*The monthly savings goal isn’t necessarily the amount that you will need to save each month. This is because for most people, you will be taking advantage of a retirement savings plan, like a 401k, that has both a savings match from your employer and will earn interest based on how it is invested.

The 15% of Your Annual Income Rule

With this method, you should plan to save at least 15% of your pre-tax income every year. Assuming that you begin saving at age 25 and will retire at 67, you will have 42 years to save and invest your money for retirement.

Save 15% of Annual Income For Retirement Over 42 Years

| Average Annual Disposable Income | 15% | Total Savings After 42 years if invested at 5% |

| $48,971 | $7,345 | $1,047,344 |

When calculating your retirement savings be sure to consider the interest rate on your savings account and how the money will grow over time. Also, consider if you will have any inheritances or other financial assets that may go toward your retirement investment.

The Benefits of Compound Interest

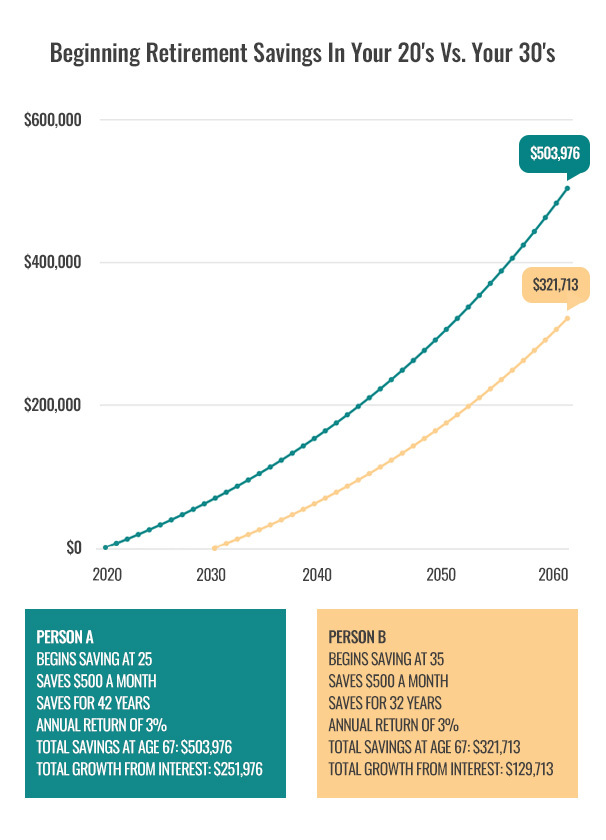

Whether you choose to use the 25 Rule or the 15% Annual Savings model, the best results happen over time because of compound interest. Financial experts agree that the best thing you can do for your retirement is to start saving early to get the most out of your compound interest.

What is Compounding Interest?

Compound interest is money you make on an investment that includes previously earned interest in the principal. This means that the interest you earn is added to the principal balance and earns future interest, growing your money faster over time.

Consider this example: person A: Saves for 10 years at 3%, person B: Saves for 5 years at 6%. Who will have more money saved?

Learn more with this Investment calculator.

Put Your Credit Card Debt Into Perspective

Now that you have an idea of how much you need to save for retirement, you should consider how your credit card debt is impacting your day-to-day finances.

Ask yourself: Can I Currently Meet My Monthly Living Expenses?

If the answer is yes, then you should look at your budget and see if the amount of disposable income that is left can be split between your credit card debt and retirement savings. To determine what percentage should go to each responsibility you should compare what you stand to make in interest on the growth of your retirement savings vs. what you stand to lose in interest until your credit card debt is paid off.

It Makes Sense to Save for Retirement Before Paying Paying Off Credit Card Debt…

You may want to consider prioritizing your retirement savings if you identify with the following conditions.

- Are nearing retirement age, you may want to make saving for your retirement fund a priority. This is especially true if you don’t have any savings or only have a small amount.

- Your employer is willing to match your 401(k) or Roth IRA contributions. You should take advantage of this money because it might make up for or exceed the interest you are accruing on outstanding debts.

- Have a small amount of debt. If you can afford to continue making the minimum payments, you can justify setting aside money for retirement before prioritizing the debt.

- You recently received an inheritance or a large sum of money from the sale of a home or car. You can use these funds to kick-start your retirement investments.

- You have a health problem or other concern that makes retirement a priority.

It Makes Sense to Pay Off Credit Card Debt Before Saving for Retirement When…

You may want to consider prioritizing your credit card debt repayment if you identify with the following conditions.

- Have equity in your home. If you own your home or have built a significant amount of equity you may be able to use that to pay down your credit card debt. A mortgage carries a lower interest rate than a credit card, so it may save you money, in the long run, to use that equity to pay down your debt so you can start saving for retirement. Paying down credit card debt creates available credit that you can use if you need it whereas paying a mortgage is a secured debt and is likely to have a more favorable interest rate.

- Are younger and have more time to pay off debt before focusing on retirement.

- Have high-interest debt but recently raised your credit score. Paying off your high-interest debt will further boost your score and you will be eligible for better debt, such as a home mortgage or car loan.

- Have a steady income or recently received a raise. Use this increase in income to prioritize paying down your debt.

4 Ways to Pay Off Credit Card Debt

Fortunately, there are many ways to approach credit card debt repayment. The one you choose depends on how manageable the debt is given your current financial circumstances. If the debt is manageable, that probably means you are easily able to make the minimum payments and perhaps even pay more than the minimum to accelerate paying down the debt.

If the debt feels like more than you can manage, you may want to consider these options: debt consolidation, home equity loan, balance transfers, or other debt consolidation options. You’ll want to choose the option that allows you to pay down the debt(s) in a timely fashion.

Debt consolidation loan: This may be ideal if you have multiple lines of credit card debt. You can pay down all the lines at once with a debt consolidation loan, then repay the loan in one manageable monthly payment. This works best if you qualify for a debt consolidation loan that has an interest rate lower than the average on all your lines of credit.

Home Equity Loan or Line of Credit: This can work well for you if you have built equity in your home. You can pay down the credit card debt by borrowing against the equity you have built in your home. Because your home is a secured asset you’ll probably be able to get a better interest rate than what you are paying on your credit card debt.

This method of repayment is not without its risks, so you’ll only want to consider this option if you feel certain you’ll easily be able to make the loan or line of credit payment.

Credit Card Balance Transfer: If your credit score is in good shape you may qualify for a balance transfer credit card.

Debt Consolidation: Accredited Debt Relief is a great alternative for people who have exhausted other options. Consolidation Specialists can help you find a plan that suits your situation.