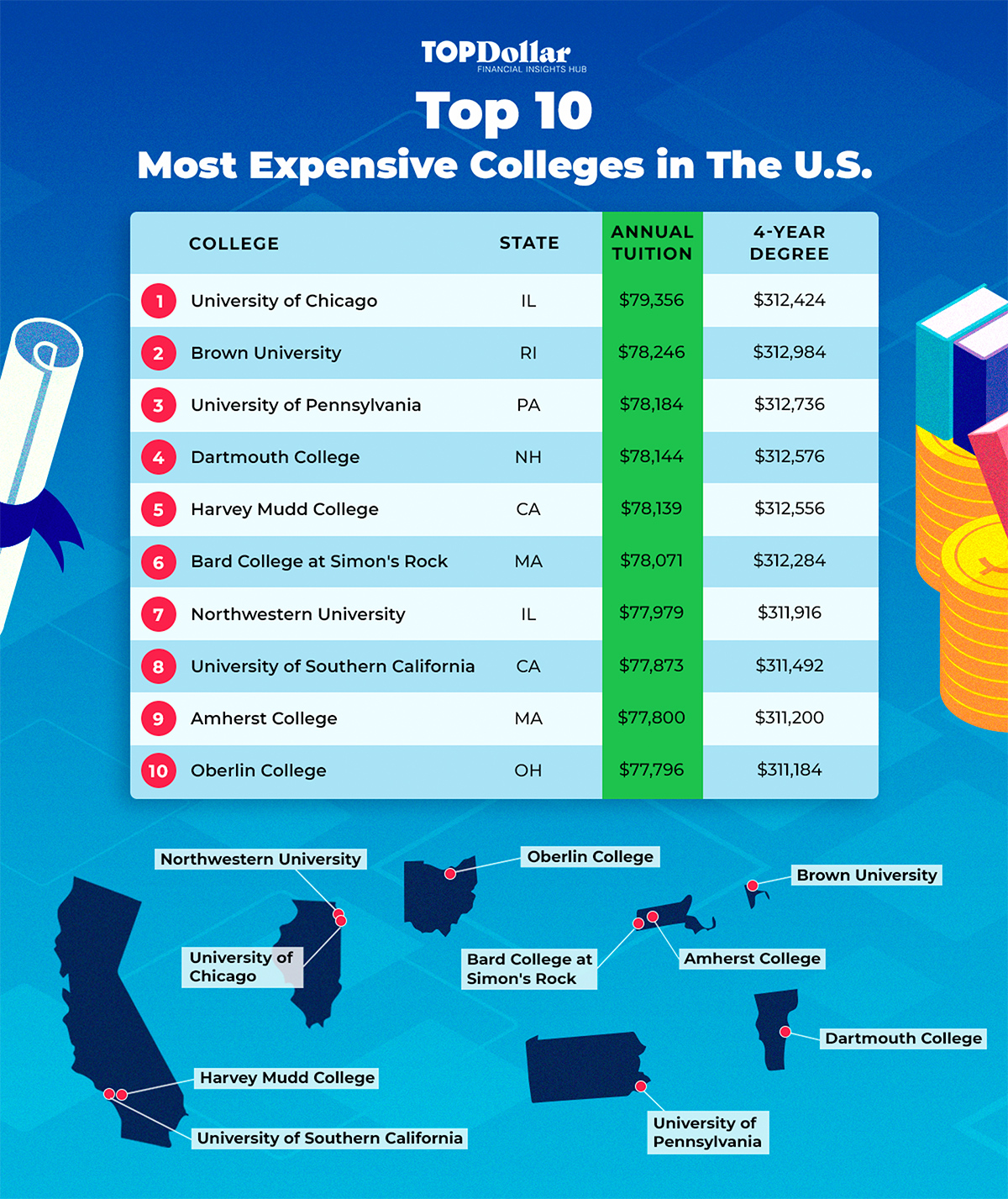

Every year, The National Center for Education Statistics ranks the 50 most expensive four-year institutions in America by their published out-of-state tuition, annual fees, and residential charges.

Unsurprisingly, many of the most expensive schools are concentrated in certain areas, including New England, the Midwest, and West Coast.

Visual College Data

- Top 10 Most Expensive Colleges in The U.S.

- The Cost of Private vs. Public Colleges

- Most and the Least Expensive States

View the full list of Top 50 Most Expensive Schools in the United States

Note: All of the prices listed here are sticker prices — that is, before any loans, grants, work-study, or any other financial aid.

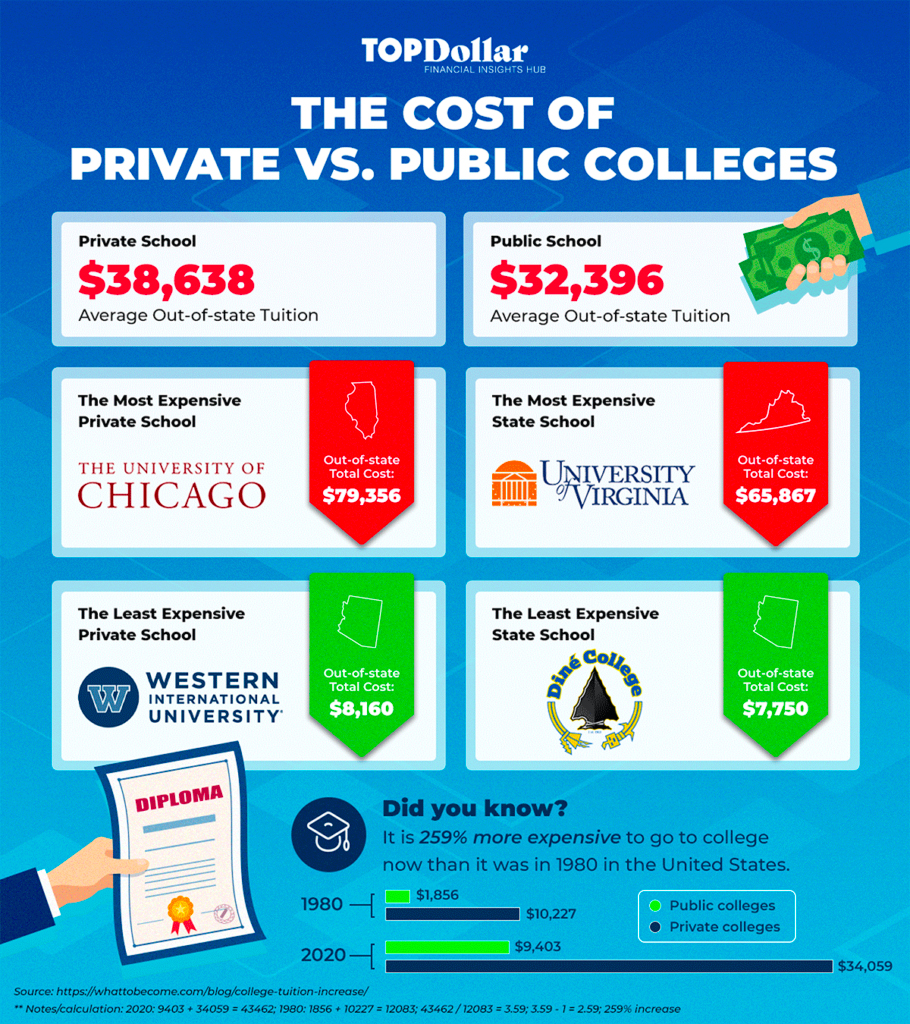

The Cost of Private vs. Public Colleges

While private schools are more expensive than state schools, the average difference in cost is less than you might expect: $6,242. Fortunately, there are affordable options in both categories.

When deciding whether to attend a private or public school, be sure to factor in the total cost of attendance (including room and board, books, etc.), as well as scholarships and financial aid offerings. With careful planning, you can find the right school for you- regardless of whether it’s a private or public university.

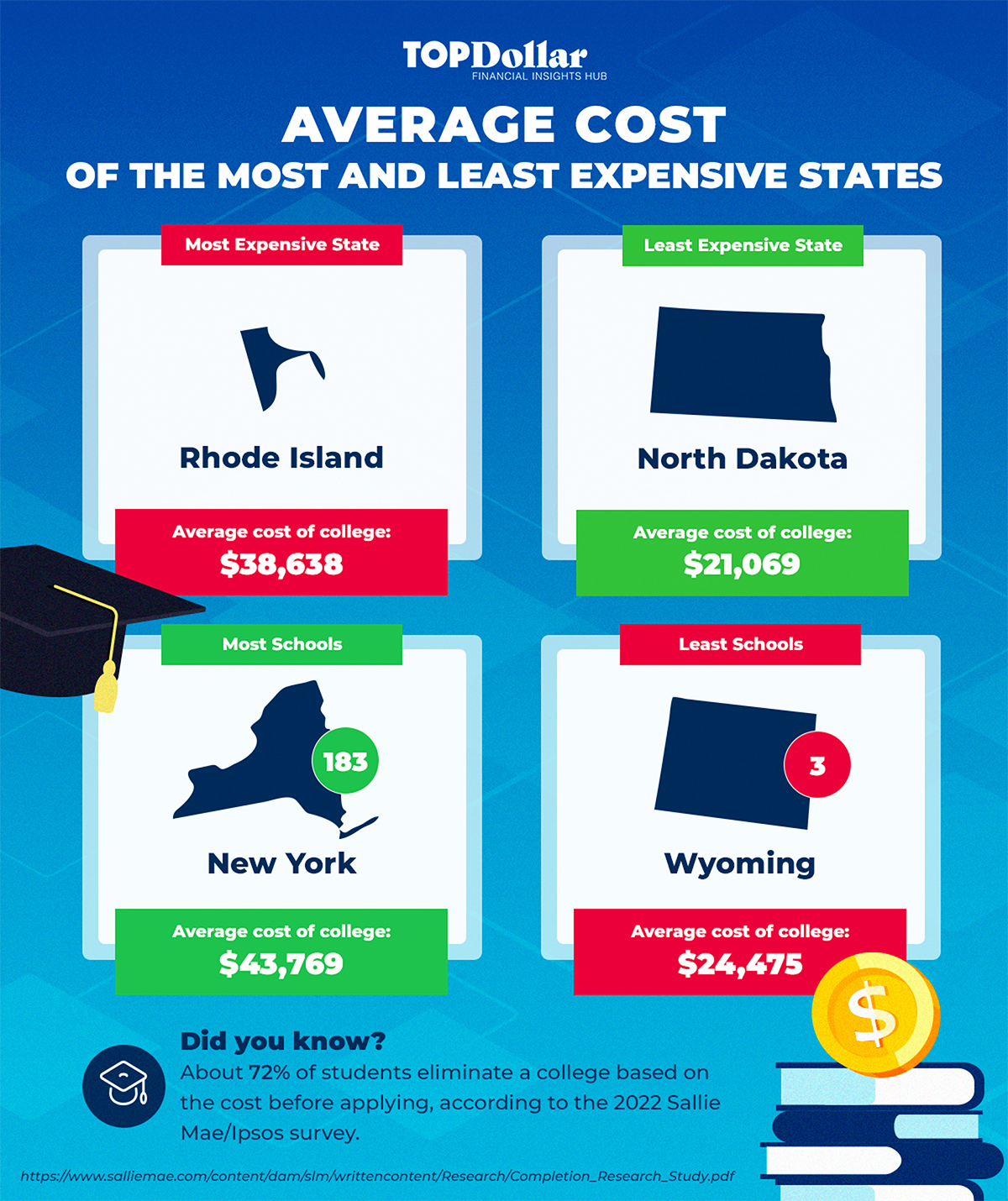

Average Cost and the Most and Least Expensive States

When you average the cost of all the schools in each state, Rhode Island emerges as the most expensive on average. Alternatively, North Dakota is the least expensive on average.

New York state has the highest number of schools, with a total of 183.

Meanwhile, Wyoming has the fewest, with only three schools in the entire state.

Choose the Right School For You and Your Budget

Attending college is a major life decision with a hefty price tag. It’s important to do your research and find the right school for you rather than just choosing the least expensive option.

There are plenty of colleges out there that provide an outstanding education without breaking the bank. Be sure to weigh all the costs and do research to figure out what you want in a college so that the one you choose meets your needs.