Although credit card debt fell briefly at the beginning of the pandemic, it’s back up now, and – guess what? – the numbers are exceeding pre-pandemic levels. What is behind this climb, and what does it mean for Americans?

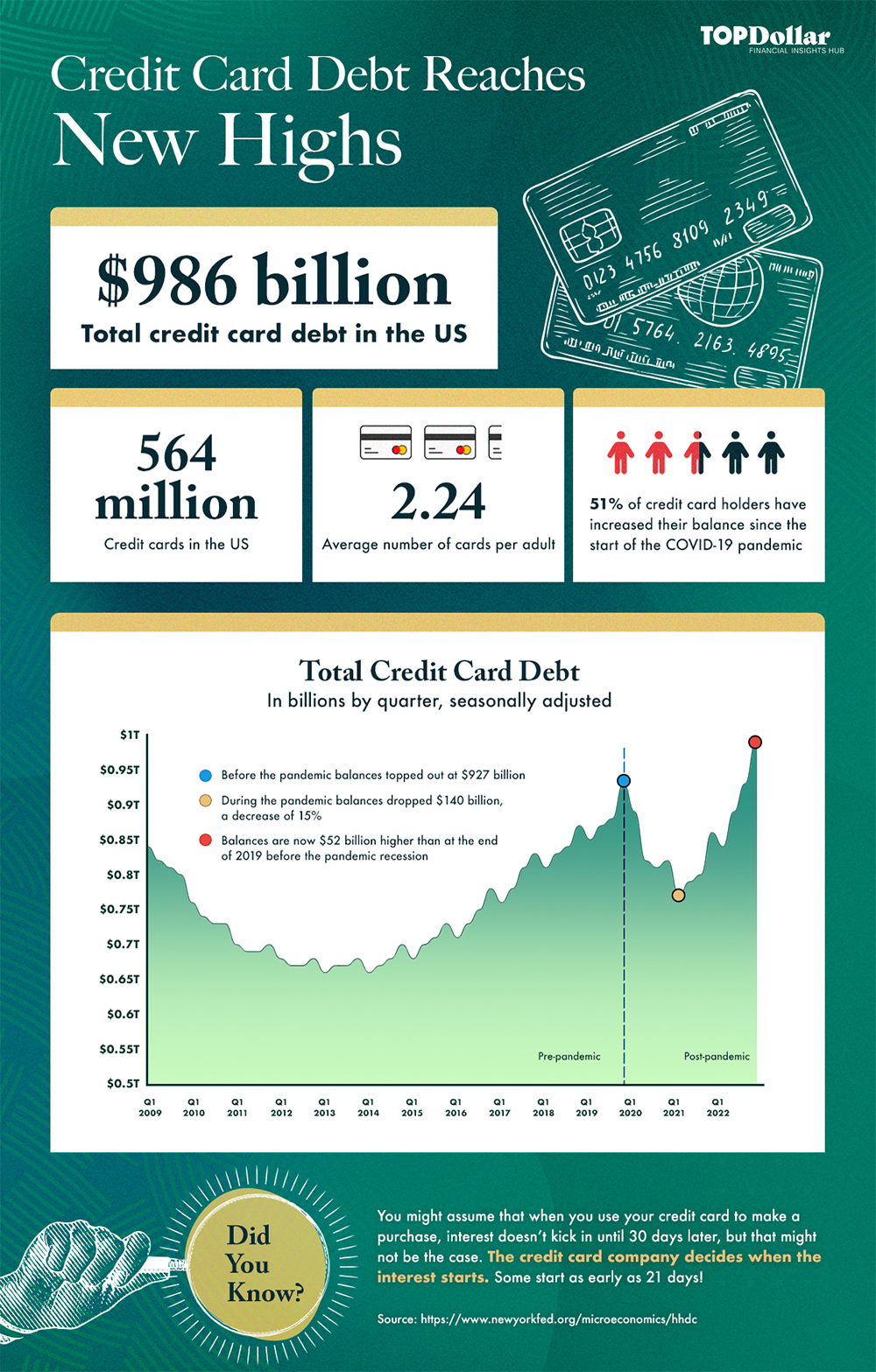

Credit Card Debt Reaches New Highs

Together, Americans hold $986 billion dollars in total credit card debt. This number is a new, all-time high that exceeds the pre-pandemic high of $927 billion by 6.3%.

Credit card balances fell during the pandemic recession by 15% in part because borrowers used economic stimulus funds to pay down and prepay their credit cards. But since then, credit card holders have more than compensated for the decline.

Roughly 191 million American adults have at least one credit card account, half of all Americans have at least two cards and 13% have at least five cards. Overall, 51% of cardholders have increased their balances since the start of the pandemic.

Reasons for Growing Credit Card Debt

Now that inflation is outpacing incomes, revolving balances on credit cards have increased. In an effort to slow down the economy, the federal government approved a 0.25 percentage point interest rate hike and is expected to raise rates six more times this year.

Americans benefited when the Fed made an emergency cut and lowered interest rates to near zero amid COVID-19 distress two years ago. But the pendulum is swinging back the other way, and borrowing is now more expensive than ever.

For 191 million credit cardholders in the United States, this means higher bills this year. And it’s all happening at a time when seasonal spending habits and behaviors have more or less returned to pre-pandemic norms.

4 Reasons for Increases in Credit Card Debt

- Inflation rates reached record highs

- Interest rates are climbing

- Revolving balances are up

- Seasonal spending is returning to normal

Learn more about the Fed’s rate hike effect on credit card APRs.

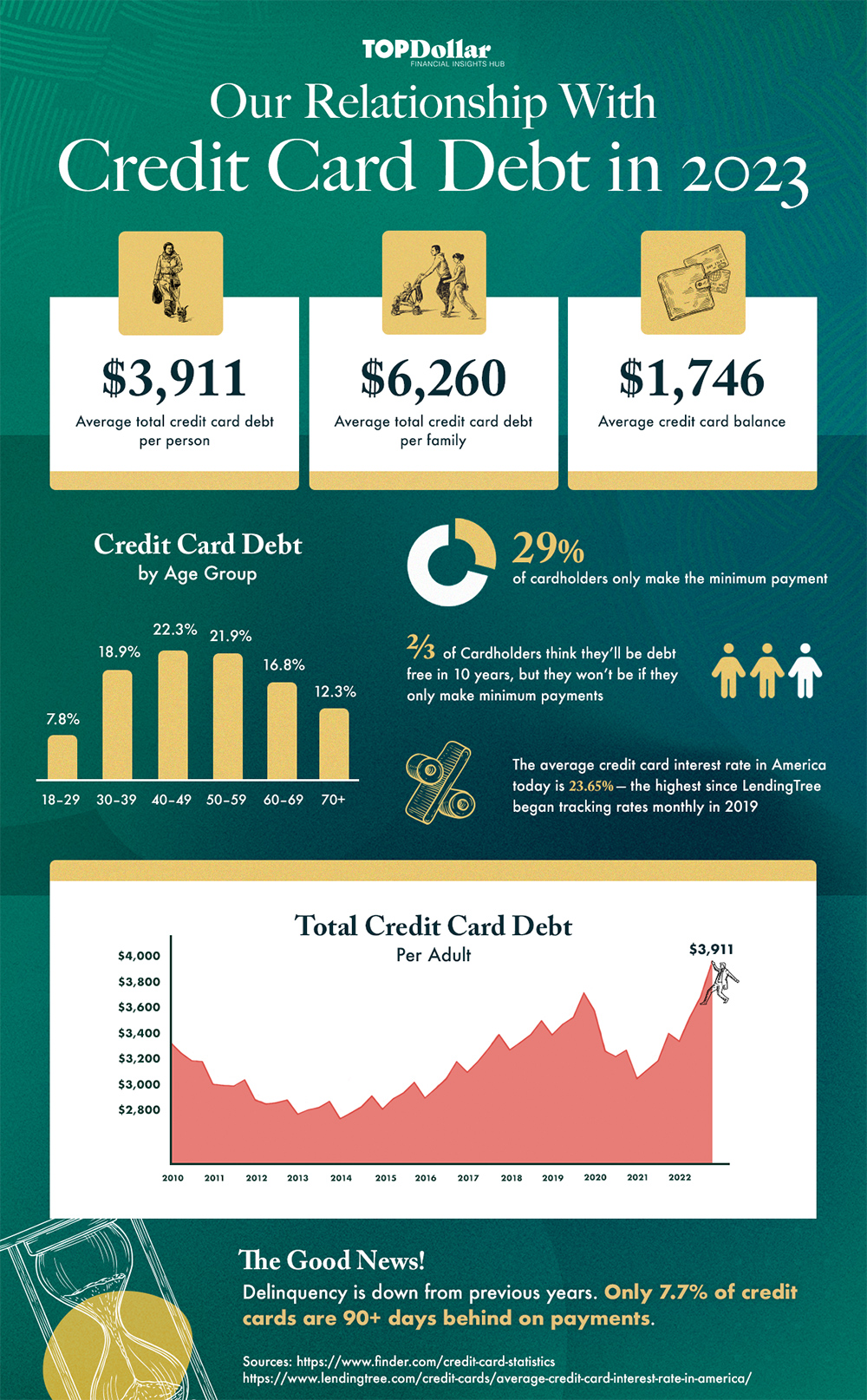

The Average American’s Credit Card Debt

The average American with credit card debt owes $3,911. Consider that with an average interest rate of 23.65% and a typical minimum payment of 2% of the balance, you can calculate that:

It will take 18 years and 1 month to pay off the balance. In this scenario, the total interest paid is $13,033.74, more than 333% of the original balance.

The numbers quickly show that making minimum payments, like 29% of cardholders, is a losing game.

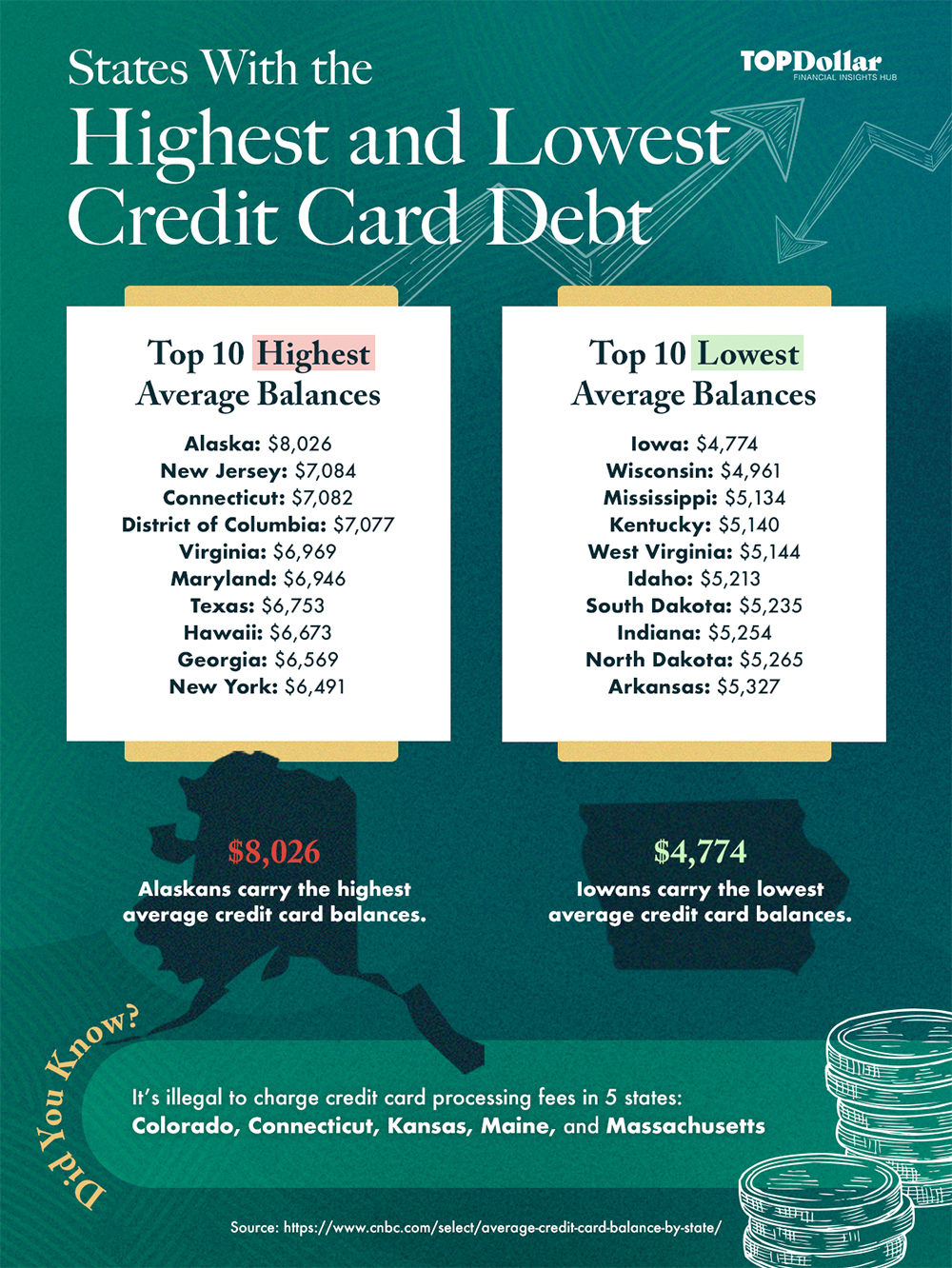

Alaska Keeps Leading America in Average Credit Card Debt

Credit card data shows that where you live can have a lasting impact on how much debt you hold. For example, Alaska continues to lead the states with the highest average credit card debt, a position it’s held for more than a decade.

The high cost of living in Alaska is likely a contributing factor. In particular, healthcare costs in Alaska are 51.7% higher than the national average.

According to Alaska Common Ground, limited competition among medical providers, high compensation for providers, and large hospital profit margins have led to higher healthcare costs.

Likewise, grocery costs in Alaska are 38.4% higher than the national average due to the state’s location. 96 percent of Alaska’s food is imported by container ships.

What does rising credit card debt mean for Americans?

For now, economists agree that the United States is heading for a recession. Despite low unemployment, American household finances are not in good shape, as statistics like those above indicate.

As we have seen in past recessions, high inflation rates and rising federal interest rates lead to more consumer debt. In turn, businesses react to inflation by cutting costs and raising prices, adding further strain on the average consumer.

What can you do to protect yourself?

While you can’t do much to stop an impending recession, there are steps you can take to make your finances more recession-proof and prevent debt from getting out of control.

- Build an emergency fund

- Payoff your debt, especially high-interest credit cards and loans

- Diversify your investments

- Redo your budget and be honest about unnecessary spending

Struggling with your creit card debt?

If you are overwhelmed with costly minimum payments and can’t seem to catch up or pay down your balances, a debt consolidation option could help you get things under control. Talk to a specialist and get a free consultation in a few minutes to see what option is best for you.