Learn About Beyond Finance and Accredited Debt Relief

Did you know that Accredited Debt Relief is a part of the Beyond Finance family?

We’re one company with two distinct brands that support people at different points in their debt-free journey. Accredited Debt Relief helps people understand their options and when a Beyond Finance program is the right fit, they step in to deliver results.

Get To Know Beyond Finance

For over 13 years, Beyond Finance has helped more than 700,000 people pay off over $2 billion in debt. Their top-rated debt consolidation option is faster and more affordable than alternatives like bankruptcy or making minimum payments.

How We Work Together To Help People In Debt

Every year, millions of people struggle with debt — and reaching out for help can be as stressful as the debt itself. With so many options available, it’s hard to know where to start!

That’s where Accredited Debt Relief comes in. Through free consultation calls, we make that process clearer and more approachable.

What to expect on a call:

- Share Your Story

- Analyze Your Needs

- Work With Your Budget

- Review Your Options

- Clear Guidance on Next Steps

On free consultation calls we listen with compassion and empathy and take time to understand your needs. We’ll also help you understand your options and choose a personalized solution that’s right for your budget. One of those solutions is Beyond Finance!

How does Accredited Debt Relief make recommendations?

That’s a smart question! Since we’re part of the same company, it’s natural to wonder how that might influence our recommendations. The truth is, we only recommend a Beyond Finance solution when we’re confident it’s the right fit. And because our fees are success-based, we don’t earn our fee unless the program works for you.

More About Success-Based Fees

Beyond Finance’s fees are success-based, meaning they only take a fee after achieving a positive result for clients. While fees are budgeted for in monthly deposits, they don’t go to Beyond Finance until they’ve been earned. That means, nothing is taken upfront but you won’t get a surprise bill later.

What to Expect With A Beyond Finance Option

When you enroll your debt with Beyond Finance they’ll make sure you feel comfortable, confident and informed throughout your journey.

Beyond Finance provides:

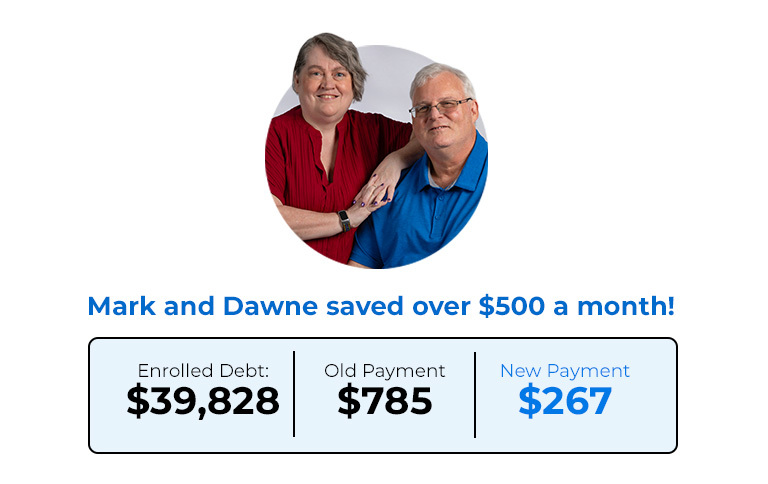

Working with Beyond Finance has been so exciting. We see a plan in motion and putting our trust in Beyond Finance–we don’t feel as bad anymore. It’s exciting to watch it in the app and be able to see how things are progressing. We’re able to get back on our feet financially and that’s important to us.

-Mark and Dawne | Real Clients

Beyond Finance Is a Trusted Name in Debt Consolidation

Beyond Finance has a strong reputation that is built on a foundation of expertise, innovation, compassion and a commitment to client success. Here’s what else sets them apart:

- Fully Accredited: Fully accredited by ACDR and backed by years of industry experience.

- Top-Rated: They’ve earned thousands of 5-star ratings on Trustpilot from happy clients.

- Award Winning: A 3x ConsumerAffairs award winner in customer service, value and process.

- Success-Based: Fees are based on positive results, so clients never pay upfront.

Compassionate Support Leads to Big Transformations

Beyond Finance delivers exceptional results, but what clients remember most is how supported they feel along the way.

People come to us during vulnerable and stressful times in their lives and Beyond Finance meets their emotional needs alongside their financial ones. That kind of care creates an environment of safety and trust, making the journey out of debt feel not just possible but empowering.

Real clients compensated for sharing real stories. Individual results may vary.

Caring Support Whenever You Need It

Reddit Testimonial

Making Financial Wellness A Priority

By prioritizing financial wellness, Beyond Finance sets clients up for success that will last well beyond their program. They help clients build better financial habits, overcome harmful thought patterns and heal their relationship with money through resources like:

- Wellness Sessions with Financial Therapists (For Clients Only)

- Budgeting Tools

- Mental Health & Money Guides

Learn More About Beyond Finance

To learn more about Beyond Finance, visit their website www.beyondfinance.com.

Ready to do something about your debt?

Your solution is just a phone call away. Schedule your free consultation now!