Updated April 12, 2023

When you hear the phrase “in case of emergency,” what comes to mind? Many individuals think of safety drills, stored nonperishables, first aid kits and calling 911. Having an emergency fund might not be on your “in case of emergency” list, but it should be one of your biggest financial priorities.

What Is An Emergency Fund?

An emergency fund is a bank account where you set aside money for large unexpected expenses like:

- Medical emergencies

- Unemployment, layoffs or furloughs

- Car repairs

- Home repairs

- Emergency travel

The Federal Reserve recently reported that 4 in 10 Americans would have difficulty paying for an emergency $400 expense. Many may cover an unexpected cost like this with a credit card, which can be problematic if you’re already in debt and unable to pay off your credit cards in full.

The best way to handle “worst case scenario” expenses is to create and maintain an emergency fund, which is a dedicated amount of money that’s meant to be used for emergency costs like illnesses, lost jobs, home and car repairs.

How Much Should I Save?

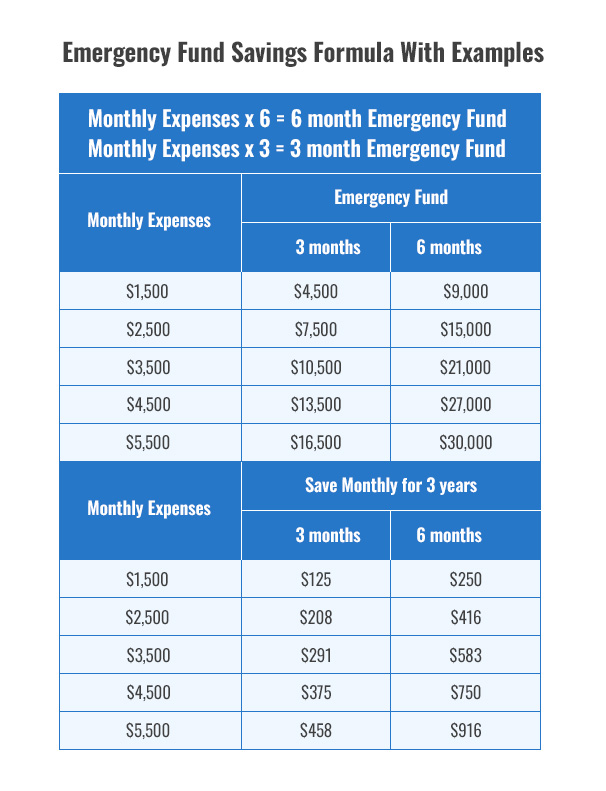

Experts recommend saving 3 to 6 months’ worth of living expenses OR starting with a minimum emergency fund goal of $1,000 until you are able to set more money aside.

Calculate your monthly expenses:

- Housing (rent or mortgage)

- Utilities

- Insurance

- Credit card bills

- Loan payments

- Food and personal items

- Travel expenses

- Taxes

Emergency Fund Examples

Saving for Emergencies

Although there isn’t a magic amount that covers every situation, many experts suggest the following emergency fund goals:

Save 3 to 6 Months of Your Living Expenses: Imagine that you were to suddenly lose your job – how much would you need to get by while you applied for new positions? Your estimated total may not include room for extravagant purchases, but it should include money for rent, food, transportation and utilities.

OR

Set an Emergency Fund Savings Goal of $1000: Multiple months of potential unemployment may be a tough goal to save for right off the bat, and that’s okay. Try saving $1,000 to start with, which can make a big difference when faced with an emergency.

Where to Store Your Emergency Fund

Ideally, your emergency fund will be kept in a separate place from your regular savings account. The temptation to spend the funds may be too strong if they are attached to your regular debit account. Open a separate savings account (ideally, at a separate bank from your primary financial institution) and rename it “Emergency Fund” to discourage you from using it for everyday purchases.

Upgrade Your Emergency Fund

Your emergency fund should be liquid and ready to withdraw at a moment’s notice, so it’s best to avoid putting the money into a CD or a Roth IRA. Instead, aim to store your emergency fund in a high-yield savings account so that your “just in case” money can still earn a significant amount of interest.

How to Save for Emergencies

If you’re struggling to balance multiple financial obligations, it may be difficult to imagine yourself being able to create an emergency fund from scratch. Use the following strategies to build your “rainy day” fund:

- Set a Specific Goal: Crunch the numbers and give yourself an exact number to save towards, and celebrate with a small reward once you meet your goal.

- Add Your Emergency Fund as a Mandatory Line in Your Budget: Treat deposits into your emergency fund like bill payments, and commit to paying a set amount with each paycheck. If you are consistent with payments, your emergency nest egg will be set in no time. Use our spreadsheet to update your budget!

- Raise Funds With a Side Job: Whether you’re working for an on-demand service, babysitting, selling your creations online or picking up shifts at a part-time job, the extra money that you earn outside of your full-time work can be stashed away in your emergency account.

- Make It a Game: Saving money because it’s “the responsible thing to do” isn’t always the best motivation, especially when your savings efforts include making cuts that affect your lifestyle and spending habits. Instead, try making it an active challenge or competition. Try to complete a “no spend” month, which can mean either cutting one category from your monthly spending (ex: no eating out, no clothes shopping, only purchasing generic brand groceries) or cutting all unnecessary spending altogether. Enlist a friend to be your accountability partner. Once you complete your challenge, reward yourself with a small treat and start on a new “no spend” goal.

- Put “Surprise Money” Towards This Fund: Your tax refund, work bonuses, monetary gifts and anything else that wasn’t worked into your monthly budget should be saved for emergencies. Once you’ve hit your emergency fund goal, keep the momentum going by putting future surprise funds towards debt repayment, investments, and the occasional “fun money” spend.

- If You Use It, Replace It Quickly: Your emergency fund is meant to be used when trouble arises, but it’s important that you replenish what you use. You’ll likely experience another monetary emergency at some point in the future – if your emergency funds are depleted without being maintained, you’ll likely find yourself in a bind down the road.

Should I Save for an Emergency Fund if I’m Paying Off Debt?

Experts disagree on whether or not you should build an emergency savings fund while you are in debt. We recommend that you DO put money towards an emergency fund while working down debt for two reasons:

- Emergencies Still Happen: Unfortunately, life doesn’t give us a break if we’re in debt. Home repairs, illnesses and job losses are bound to occur whether or not you’re in a good place financially, so it’s best to prepare for the worst before it sneaks up on you.

- Leaning on Credit Cards for Emergencies Can Create More Debt: If you’re already working on paying off your existing debts, the last thing you want is dig yourself into more debt again with a credit card. Using an extra $500 set aside for an emergency home repair is always better than putting a $500 charge on a card; in the later scenario, you’ll likely be stuck paying interest on top of what you owe.

Whether you’re working out of debt or have savings on hand, dedicating a set amount of money to your emergency fund can reduce the stresses that come with accidents, disasters and unfortunate life events. By thinking ahead and using smart savings strategies, you can build a healthy “in case of emergency” stash that can provide financial protection while you deal with the unexpected.