Let’s say you’re in dire need of cash. You might be struggling to work your way out of debt. Maybe you had an unexpected emergency with a big price tag. There’s a stash of cash available in your 401(k), but you’re technically supposed to save that money for retirement. Should you tap into your retirement savings if you really, really need it?

In this article, we’ll explore the complexities of withdrawing money from your 401(k) before retirement, whether or not it’s a good idea, and the temporary changes to 401(k) withdrawals that came with the 2020 CARES Act.

The Basics: What Is a 401(k) and How Does It Work?

A 401(k) is a retirement account that’s offered to employees by their employers. Typically, employees contribute a specific percentage of their pre-tax salary to their 401(k). They also have the ability to choose specific types of investments from the offerings provided by their employer, which allows their 401(k) money to grow over time. These are usually a range of stocks, bonds, cash and mutual funds.

Many employers offer to match some or all of their employee’s 401(k) contributions up to a set limit. Here’s an example: a company may offer to match dollar-for-dollar the first 4% that an employee contributes to their 401(k). Jane Smith contributes 4% of her $40,000 salary to her 401(k) every year. Jane’s $1,600 contribution is doubled and turns into $3,200 thanks to her employer match.

401(k)s also come with different tax breaks. For traditional 401(k)s, you’ll make pre-tax contributions, which can help lower your taxable income now. Roth 401(k) contributions are after-tax, meaning that you won’t have to pay taxes on what you withdraw in the future when you retire.

These retirement funds are also protected – the Employee Retirement Income Security Act of 1974 (ERISA) keeps creditors from making claims against funds in retirement plans like 401(k)s.

Typically, 401(k) owners don’t withdraw their funds until after retirement. You must be at least 59.5 years old or meet specific hardship requirements in order to access your 401(k) funds without paying a 10% early withdrawal penalty.

Are All 401(k) Plans the Same?

Each retirement plan and provider has different rules when it comes to 401(k)s. Check with your 401(k) provider or your employer’s human resources department to get the full details on your account.

Can I Cash Out My 401(k) From a Previous Employer Before I’m 59½?

While the technical answer to this question is “yes,” we highly discourage it. Even if you’ve left the company, pulling any 401(k) money you earned there before you’re 59.5 is still considered to be an early withdrawal. That means it’s subject to a 10% early withdrawal penalty in addition to federal and state income taxes.

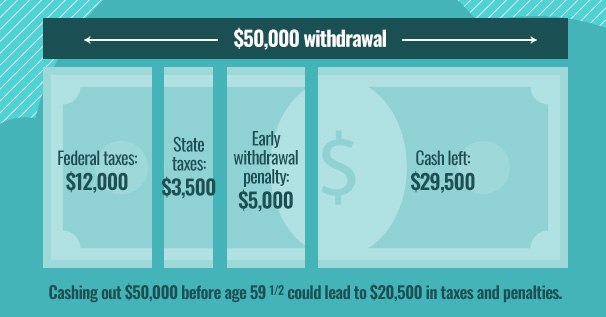

Fidelity illustrates this with a cash-out example. After factoring in the early withdrawal penalty and hypothetical state (7%) and federal (24%) income taxes, an early $50,000 cash-out would mean the 401(k) owner would only be able to take $29,500. That’s a loss of $20,500!

Fortunately, there are ways to keep your retirement funds growing after you leave a job. Most companies allow former employers to leave their retirement savings in the same 401(k) plan without adding additional contributions. You can also roll the funds over to an IRA or your new employer’s plan.

Can I Pull From My Current 401(k)?

This depends on how you’re planning on withdrawing the money, and it also comes with caveats. If you qualify for a hardship distribution, you can make a withdrawal without being burdened with the 10% penalty fee, but you’re still responsible for income taxes on this money. Your withdrawal amount will also likely be limited to the amount you actually need, and you may be required to provide proof to your employer that you weren’t able to get the money you’re requesting from another source.

Some employer plans offer 401(k) loans, which allow you to take up to 50% of your savings (up to a maximum of $50,000) within a 12 month window. Those who take this type of loan aren’t burdened with the taxes and penalties that come with early withdrawal. However, they will be required to pay the borrowed money back, plus interest, within a set time period determined by your particular 401(k) plan. Additionally, if you lose your job and still have a 401(k) loan out, you may have to repay what you borrowed in a condensed time frame to avoid getting hit with taxes and early withdrawal penalties.

Still Considering an Early 401(k) Withdrawal or 401(k) Loan? Ask These Questions First.

Are you eligible and able to withdraw funds?

If you’re under 59.5, you’ll likely need to meet particular hardship requirements in order to make a 401(k) withdrawal. Even if you do meet the requirements, employers aren’t required to offer hardship withdrawals or loan options, and they may limit your ability to access the portion of your 401(k) that they matched. Check with your company’s HR department or the plan provider to learn more about your plan’s requirements.

Do the pros outweigh the early withdrawal penalties?

Withdrawing from a retirement account before you turn 59½ can trigger tax obligations and early withdrawal penalties. You’ll also need to consider how an early withdrawal may affect your tax bracket; pulling the money and having more income now could cost you more during tax season.

While 401(k) loans come with fewer upfront penalties, they can still be risky. If you lose your job before you’re able to pay the money back in the designated time frame, you’ll need to return the funds quickly in order to avoid taxes and penalty fees.

Am I okay with having reduced funds when I retire?

Retirement funds are important for your future. Making an early withdrawal now may provide relief today, but it reduces the amount of money that you’ll have later. The best way to maximize your retirement savings is to make deposits early and allow that money to grow for as long as possible.

What 401(k) Changes Came With 2020 and 2021 COVID-19 Relief?

The current COVID-19 health crisis affected the economy greatly, leaving many Americans without a steady income or a financial safety net to rely upon. As a way to provide financial relief, Congress passed the CARES Act and the Consolidated Appropriations Act, 2021, which allow those who meet specific COVID-19 related qualifications to borrow up to $100,000 from eligible retirement plans, without penalties.

While this CARES Act feature was originally set to expire at the end of 2020, the latest relief bill allows individuals to take retirement plan distributions for 180 more days after the bill’s enactment.

It’s important to note that employers aren’t required to adopt the CARES Act changes. Check with your employer and the IRS Coronavirus Tax Relief and Economic Impact Payments page to learn more.

Summary – Leave Your 401(k) Money Alone

Borrowing or withdrawing from your 401(k) might seem like a convenient solution to today’s problems. However, it can greatly hinder your future financial security. Ultimately, you’re the one who makes the final call when it comes to your money, but we personally don’t think that early withdrawals are worth the risk.

If you’re currently in a monetary bind, these articles may be able to help:

The information provided in this article is not intended to constitute specific legal, tax or financial advice. Instead, all information, content and materials available are for general informational purposes only. You should consult a legal, tax or financial professional with respect to your particular situation and circumstance.