If you’ve explored your credit card options or looked into a mortgage or car loan, you’ve likely come across the term APR. This number can be a quick way to compare borrowing costs, but understanding what goes into the calculation and what this percentage truly means can be tricky.

In this article, we’ll break down the basics of APR, how it applies to credit cards and loans, and the most important things to remember when reviewing your options.

What Exactly is an APR?

APR is short for annual percentage rate. This percentage expresses the yearly cost of funds charged to borrowers over the term of a loan. APR can also be thought of as the actual cost of borrowing the money.

A financial product’s APR is expressed as a percentage that includes interest, fees and other costs related to the loan. Lower APRs are usually better, as they suggest that the annual cost of borrowing will be lower.

APRs provide a more holistic view of how much a financial product might cost. They can be used to easily compare your borrowing options. Your APR can be found on your loan agreement, as well as on your loan’s statements.

Interest Rate vs. APR

APRs and interest rates are two separate things. A loan’s interest rate is the rate that a borrower pays on a loan, excluding any other costs. The APR of that same loan includes the loan’s interest rate and any additional fees associated with that loan.

The only exception is with credit card APRs. While you may have additional expenses tied into your card, such as an annual fee, penalties for late payments or charges for cash advances, credit card companies don’t include these in their APR calculations.

How Do I Calculate My APR?

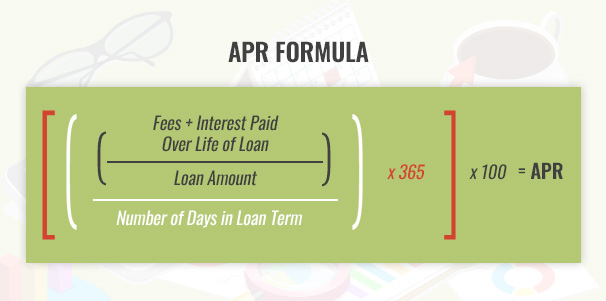

You can calculate the APR for most loan products by using the following formula:

Note that this calculation does not include compounding interest rates, but it can help to visualize the cost of your loan for one calendar year.

APR and Your Credit Card

If you’re the type of person who pays off their ending balance every month by the due date, APR won’t be your biggest concern.

“The most important thing to remember with respect to credit card APRs is that as long as you pay off your balance in full each billing period, you’ll never be charged interest, so you won’t have to worry about APR at all,” said Sean Messier, associate editor of Credit Card Insider.

For those of us who do carry a balance month to month, a few different costs may come into play. Before committing to a credit card, read the fine print and familiarize yourself with the following:

- Variable APR: This means that the APR is based on an index interest rate, like the prime rate published in the Wall Street Journal. The cardholder agreement, which can be found on the cardholder’s website or requested from the card issuer, will explain how the APR can change over time.

- Fixed APR: This means that the APR doesn’t change based on an index. This doesn’t mean that your APR won’t ever change though; if it does, the card issuer is required to let their card holders know in advance of the change.

- Introductory APR: This is a lower interest rate that credit card companies often give to new customers for a set amount of time after they open their account. While this can be an amazing incentive, remember that this deal is temporary – make sure you know what the APR will be after the introductory period ends!

- Purchase APR: This is the interest rate that’s charged on purchases when you don’t pay off your balance in full every month.

- Cash Advance APR: This APR comes into effect if you use your card to withdraw cash. It’s often higher, as lenders consider this practice to be a riskier move, so we recommend that you avoid withdrawing a cash advance unless it’s absolutely necessary.

- Penalty APR: This is a higher APR that comes into play if you’re late on a payment or spend beyond your credit limit. Setting up autopay and spending alerts can help you avoid making these mistakes and racking up these charges.

- Balance Transfer APR: This is the interest charged if you move your balance on one card to another card, which is a practice commonly used in debt consolidation. If you’re trying to consolidate your debts on a new credit card, be extra mindful of this one – a credit card advertising a 0% balance transfer APR might be hiding a higher interest rate.

APR, Loans and Mortgages

APR gets more complex when it comes to loans and mortgages, as these percentages include more than just the interest rate. These additional costs will vary depending on the type of loan you’re looking at, but these are common costs that may be included in a loan’s APR:

- Underwriting Fees: This is the fee for the person who reviews your loan application.

- Processing Fees: Many different things can fall under this category. Be sure to read the fine print and ask your lender for more information.

- Document Fees: These are related to drawing up the loan’s documents that you’ll be required to sign.

- Appraisal Fees (mortgages): This is paid to the person who reviews the home and calculates its value.

- Origination Fees (mortgages): This can be any fee that adds to the profit that your lender will make on your loan. These are negotiable, so be sure to ask questions, shop around and negotiate!

- Closing Costs (mortgages): This category can vary, and usually includes things like property taxes, discount points and appraiser fees.

- Mortgage Insurance (mortgages): If you make less than a 20% down payment, or if you take out a FHA or VA loan, you’ll likely be required to take out mortgage insurance.

While APRs for loans and mortgages can help you gain more insight beyond the interest rate, they’re based on the assumption that the borrower is making a long term commitment. Dan Green, founder and CEO of Homebuyer, considers APR to be a meaningless number for most people who are shopping for homes.

“It’s a backwards-calculation based on the cost of living in a home for 30 years with a fixed mortgage, and never refinancing even one time,” Green explained. “The APR calculation adds the 30 years of projected mortgage payments to the loan’s initial closing costs and then says, “If you paid this much money over 30 years based on borrowing this much money today, we would look back and realize your true interest rate was this percent. Except that people don’t stay in homes for 30 years. And, they sometimes use adjustable-rate loans. And, they refinance fairly regularly.”

Are Lower APRs Always Better?

In most cases, lower APRs are better. However, there are times when the lowest APR isn’t the best deal. For example, a lender may advertise a low APR, but that appealing percentage might come with the expectation that you pay much higher upfront costs and fees. If you aren’t able to pay thousands of dollars more towards the beginning of your loan, this type of deal isn’t for you.

Advertisements that showcase low APRs can also be deceiving. Many lenders show off low APRs and mortgage rates that they could offer a borrower, but it doesn’t automatically mean you’ll qualify for them. Unless you have perfect credit or are paying a large down payment, lenders are likely to offer you APRs that are higher than advertised.

Main APR Takeaways

APRs aren’t perfect, but they can be a quick and helpful way to compare how much a credit card or loan might cost you. Here are our biggest recommendations when it comes to APR:

- Use APR as a point of reference: While APR is a great place to start, borrowers should research as much as possible before agreeing to a loan or credit card.

- Lower is usually better, but not always: That temptingly low APR rate could be hiding high upfront payments or additional fees. Read all of the fine print and review what is and isn’t included in your financial product’s APR.

- Ask questions and speak to a financial advisor: Let’s face it – while APRs can be a quick way to understand how much a loan costs, they can also be misleading and confusing. Don’t be afraid to ask lenders for more information, and consider reviewing your options with a trusted financial advisor before making your final decision.