Updated July 2020

If you have multiple forms of debt, you are probably familiar with the frustration of keeping track of many different interest rates, payment amounts and due dates. Managing multiple debts can be stressful, especially if you struggle to organize your finances or have an irregular income. Add late or missed payments to the mix and you can quickly be drowning in debt. If this sounds familiar, it could be time to consolidate your debt.

A quick guide to debt consolidation.

You Might Need Debt Consolidation When…

1. You Forget When Your Bills Are Due

If you are chasing down your debts every month and can’t seem to keep track of what you owe or when you owe it, consolidation could help you get on track. Debt consolidation can help you bring multiple accounts, cards, and loans together under one new account.

Bonus! You’ll only have to remember one login, one due date, and one payment amount. Simplifying your debt makes it much easier to manage. You’ll be less likely to miss a payment and more likely to continuously make your payments on time.

2. Most or All of Your Debts Have High Interest Rates

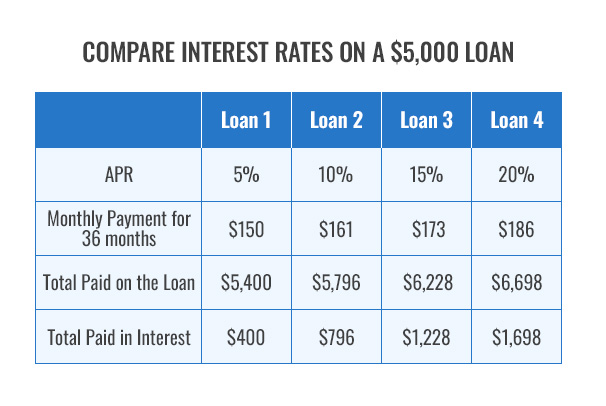

Interest adds up and even a few percentage points difference between multiple forms of debt cost you thousands of dollars over the course of a few years. For example, if you have four $5,000 loans, but they all have different interest rates the higher interest loan will cost you much more over the course of a year than you might guess.

This comparison only shows the difference in cost for various APRs. Higher interest rate loans may also have higher origination fees and late fees. All of this will add up over time.

3. You Need to Improve Your Credit Score

If you have fallen behind on your payments or can’t seem to pay down your debt, your credit score is probably suffering. Perhaps you are hoping to buy a home or get a loan for a new car. It’s not a good idea to apply for these until your existing debt is under control. Once it is, your credit score will improve, which will set you up for better interest rates on future debt.

| The effect of debt consolidation on your credit score |

| Consolidating your debt may temporarily lower your credit score, but making regular, on-time payments that lower your principal balance will have a positive impact on your credit score long term. |

4. You are Suffering as a Result of Your Debt

Money can’t buy happiness, but debt can cause distress. Managing several different debt accounts, such as credit cards, medical bills, and personal loans, can be overwhelming.

Having to remember different usernames and passwords for each debt as well as different due dates, it can be easy to miss a payment. Financial problems can become all-consuming and have a negative impact on your mental health and quality of life.

Additionally, debt can exacerbate existing mental health conditions, so it’s best to deal with your finances as soon as possible to avoid the unhappiness and distress

You are Ready to Consolidate Your Debt When…

5. You Have a Steady Income

If you have a steady income, you’ll be able to plan for a monthly payment that will make your consolidation plan a success.

Debt consolidation may last about 1-5 years, depending on your consolidation plan. If you use a balance transfer on credit card debt, you will usually only have 24 to 18 months of 0% interest on the new card. Once the introductory offer expires, you’ll be back to paying the large interest rates charged by credit card companies.

If you choose a debt consolidation loan, your total debt may be stretched out over a longer period of time. However, depending on your new loan terms, you may have a higher monthly payment in order to reduce interest.

| Credit Tip |

| It may be wise to avoid taking on new debts while you are paying off your consolidated debt. This is not always possible, but you’ll want to make sure that you don’t overextend yourself with new debt while your old debt is still being resolved. Good credit usage habits will help you repair and maintain a good score. |

6. You’ve Made a Budget

A key but sometimes overlooked component of debt consolidation is having the discipline to create and follow a budget that focuses on paying off your debt. This may require you to make some sacrifices, but don’t worry, the reward for this determination is usually reduced or eliminated debt and a brighter financial future.

7. You and Your Family can Commit to a Repayment Plan

It’s important to make sure that your family members are on board with your plan to resolve your debt. This applies to anyone with whom you share finances. Having the discipline to commit a part of your paycheck to pay off your debts and resisting the urge to take out new debts will be important for your success.

8. You Might Qualify for Better Terms

Having multiple debts doesn’t always mean you have a poor credit score. If you make your minimum monthly payments, you may have retained a fairly good credit score even as your debt has risen. This good credit can help you consolidate your debt.

Some debt consolidation options like credit card balance transfers or consolidation loans work by opening a new account or taking out a new loan. For those options, you’ll likely need to have good credit to be able to qualify for credit cards with 0% introductory offers or good terms on a new loan.

| What if I have bad credit? |

| Working with a debt consolidation service gives you a better chance of finding the right debt consolidation solution for bad credit. |

Find a Debt Consolidation Option that Works for You

If you related to any or all of these signs, it is time to consolidate your debt, you can get started today. Working with a trustworthy debt consolidation provider gives you access to Consolidation Specialists who can help you choose a solution that’s right for you and your debt.

Find out more about debt consolidation today to see if it’s the right choice for you.