When your employer offers a retirement savings plan like a 401(k), saving for retirement can seem easy. These plans allow you to automate your savings so you can set it and forget it. If your employer doesn’t, not only do you miss out on benefits like a savings match, but you may not know how to begin planning for retirement.

Unfortunately, this is the reality for many who are employed in the service industry, gig economy, work part-time, are self-employed or operate small businesses.

More than one-third of all working Americans don’t have access to a 401(k or other employer sponsored retirement plan. Without access through your employer, you could miss out on a wide variety of benefits that make saving for retirement easier.

Quick Links

Find Your Retirement Plan

Freelancers and Independent Contractors

Self-Employed Small Business Owners

Part-Time and Minimum Wage Workers

Making More Than Minimum Wage at a Small Business

Waiting to Become Eligible for a 401(k)

Information

Order of Operations for Retirement Savings Accounts

Tax Advantages of Retirement Savings Accounts

Retirement Savings Plans Compared

Non-Employer Retirement Savings Plans Options, With Examples

Social Security and SSI

Order Of Operations for Retirement Savings Accounts

Generally, the order of retirement account acquisition goes like this…

- Get a 401(k) or Solo 401(k), if you are eligible

- Get a Traditional IRA to max out your retirement savings contributions

- Get a Roth IRA to maximize your tax-free capital gains

- Invest in non-employment or employer based accounts like stocks and bonds

Once you have a primary retirement account, typically a pre-tax (401(k), Solo 401(k) or Traditional IRA), you can add on other accounts to maximize your retirement savings.

The Tax Advantages of Retirement Savings Accounts

Most retirement savings accounts, including non-employer options, are considered “privileged”or “tax-advantaged” accounts. This means you have the ability to minimize the amount of taxes you will pay on your contribution and its capital gains.

Retirement accounts fall into two categories: pre-tax and post-tax. With pre-tax accounts you don’t pay taxes on the money or its capital gains until you withdraw it during retirement. At that time you will pay whatever tax rate applies to you under the current laws and your current tax bracket.

Post-tax accounts require you to pay taxes on the money before you invest it. However, these accounts can be incredibly profitable because you aren’t required to pay any taxes on the capital gains as the account grows. Generally these accounts have the ability to make a lot of “tax-free’ money through compounding interest, and so the contribution limits are much lower than their pre-tax counterparts.

What Am I Missing Out on Without an Employer Sponsored 401(k)?

The biggest advantage of an employer plan is free money from an employer match. Depending on the terms of your 401(k) plan, contributions to retirement savings may be matched by employer contributions based on a percentage of the employees annual income.

For example, let’s say your employer offers a 100% dollar-for-dollar match on all your contributions, up to a maximum of 4% of your annual income. If you earn $60,000, the maximum amount your employer would match each year is $2,400. In order to receive this benefit, you would be required to contribute $2,400 (4% of your salary) to your 401(k) for a total savings of $4,800. Any contribution above that would go unmatched.

While missing out on an employer match is disappointing, the other benefits are available in some form through non-employer savings accounts.

Look for:

- Automatic deductions from your paycheck

- Tax-advantaged growth through investment options

- Incentives to delay distribution until retirement age is met

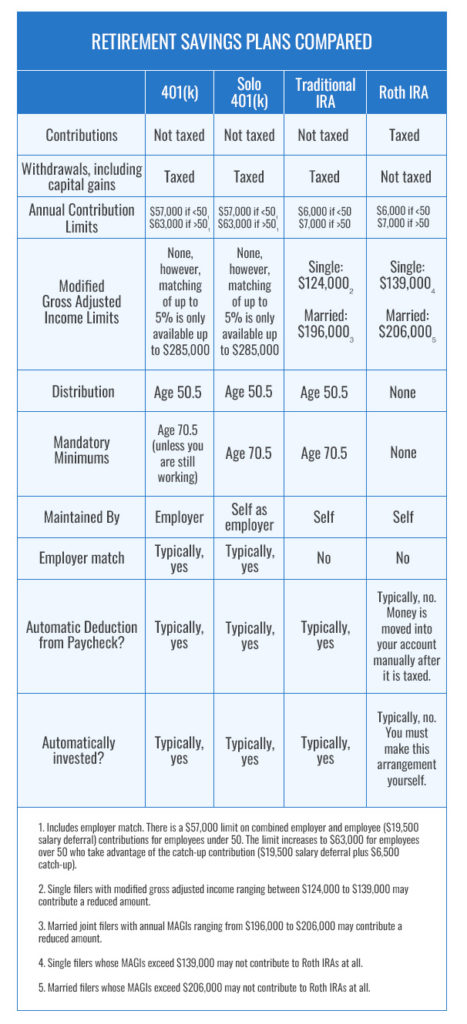

Retirement Savings Plans Compared

401(k)’s have become synonymous with retirement savings because they are one of the most common plans. However, there are many other options that do not require sponsorship from your employers.

Most of these options are considered supplemental to a traditional 401(k), but can work well for you as your primary retirement savings account.

Let’s take a look at your retirement plan options, including how the alternatives stack up against a traditional 401(k).

For more information, view the IRS contribution guidelines for 2020.

Pick the Right Retirement Savings Plan for You

Consider your personal circumstances when deciding which non-employer retirement to choose. We’ve made some suggestions based on your employment type.

Freelancer or Independent Contractor in the Gig Economy

Solo 401(k)

If you work as a freelancer or independent contractor and file a 1099, you are operating a small business and are eligible for a One Participant 401(k); also known as a Solo 401(k). Fortunately, you don’t need to set up an LLC to be eligible. You simply need to be self-employed and the sole proprietor of your income source.

For the purposes of your contribution, you’ll be acting as both employer and employee so you can deposit money into the account up to the combined contribution limit.

Save more…

If you reach your contribution limit with your Solo 401(k), you can open a supplemental account like a Traditional IRA or Roth IRA

Self-Employed Small Business Owner

Solo 401(k)

If you own a small business and are the sole employee, a Solo 401(k) is a great option. This plan has higher contribution limits compared to a Traditional IRA or Roth IRA. Because you are acting as both employee and employer, you can make contributions from your salary as well as an employer match from your “business account” up to the combined contribution limit.

Save more…

If you max out the contribution limit on your Solo 401(k), you can open a supplemental account like a Traditional IRA or Roth IRA.

Part-Time or Minimum Wage Worker

Traditional IRA or Roth IRA

Many people who work in retail, restaurants and other service related jobs make minimum wage and do not have access to benefits. Minimum wage earners, especially those who work part-time or have a family, may live below the poverty line in their areas.

For folks with lower incomes, a pre-tax Traditional IRA is probably the best place to start. This allows you to deduct your retirement savings from your taxable income. This means that you’ll pay less in taxes right now, and the taxes on retirement savings won’t be assessed until you withdraw the money during retirement.

If your minimum-wage job or part-time job is temporary, and you know you’ll be eligible for higher paid work in the near future, you may want to begin with a Roth IRA. You’ll have to pay your taxes up front, but as long as you can afford them, you’ll avoid paying taxes on your money later on. Plus, your capital gains will be tax-free! Unfortunately, Roth IRAs have low contribution thresholds, so you’ll be limited in what you can contribute annually.

Save more…

In addition to this, consider using an investment app like Stash or Acorns to begin investing right away. Unlike traditional investment accounts with brick and mortar banks and brokerage firms, these apps allow you to invest amounts as small as $5.00 and buy fractional shares. The apps will create a portfolio based on your desired level of risk.

Making More Than Minimum Wage at a Small Business

Traditional IRA

If you work for a small business but make more than minimum wage, you should get a pre-tax Traditional IRA and supplement it with a Roth IRA and other investments. Your goal should be to get as much money as possible into each of your retirement accounts.

Save more…

If you have substantial savings potential beyond what you are putting into your Traditional IRA or Roth IRA, investing your money in stock and bonds is a great way to see additional growth.

Waiting to Become Eligible for an Employer Program

Traditional IRA or Roth IRA

Some companies require a waiting period before you become eligible for a 401(k). If you would like to save for retirement while you wait to become eligible, consider a Traditional IRA or Roth IRA. You can begin saving right away and then use the account you created as a supplemental retirement savings account once you are able to access your employer benefits.

Save more…

If your savings potential goes beyond what you are allowed to put into your retirement savings accounts, consider investing your money in stocks and bonds. This is a great way to see additional growth.

A Deeper Dive Into Non-Employer Retirement Savings Options, With Examples

Solo 401(k): A Solo 401(k) retirement plan is available to self-employed small business owners with no full-time employees. This plan comes with restrictions, including a stipulation that you must not employ anyone other than yourself (you can, however, use the plan to cover you and your spouse). Like traditional 401(k)s, Solo 401(k)s allows you to make an individual contribution and an employer match up. Contribution limits apply.

Solo 401(k) helps a marketing consultant maximize retirement contributions.

“I run a small solo marketing consultancy and opened my Solo 401(k) account with Vanguard in 2015. As a consultancy, my business has high cash flow and very few depreciable assets.

The Solo 401(k) has been a very versatile retirement tool because it allows for both salary contributions and business income contributions. I’m able to save at a high rate while reducing W-2 income and business income liabilities.

I am allowed to contribute up to $19,500 against my salary. But additionally, the business can contribute up to 25% of my salary, which is deducted from my business income as a business expense.

Depending on my salary and business income, some years I have been able to save up to $56,000 in a year.

I strongly prefer it to a Traditional IRA. The Solo 401(k) has much higher contribution limits and no income limits. The only weakness is that it is tied to my company, so it will be tricky to administer as my business evolves towards retirement age.”

Nate Shivar of ShivarWeb

Traditional IRA: An Individual Retirement Account (IRA) allows individuals to place pre-tax income into a retirement investment account that can grow tax deferred. This means the IRS assesses no taxes on capital gains or dividends until the beneficiary withdrawals the funds. There are contribution limits, and certain income thresholds apply. Traditional IRAs are typically used in conjunction with a Traditional 401(k) so that the beneficiary can maximize their tax deferred retirement savings.

Small business owner grows retirement savings with traditional and Roth IRAs then invests in real estate.

“I began by opening my first Roth IRA when I was 16 and since then, have used a mix of Traditional and Roth IRAs to invest. Because I started early and made annual max contributions throughout my 20s, I was able to build up an IRA balance just shy of $100,000 by the time I was 30 years old.

In the last three years, I have decided to self-direct my IRAs, both Traditional and Roth, and have chosen to invest in real estate. I focus on passive investments that grow my account hands-free just like stocks, opting instead for the stability that commercial real estate can bring to a retirement account.”

Josh Plave Founder of Wall to Main

Roth IRA: A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. The account comes with rules that govern how and when you can withdraw your money without a tax penalty. You must have your account for a minimum of five years and be 59.5 years of age or older.

Roth IRAs have substantial tax benefits, but there are contribution and income limits. For that reason, they are typically used in conjunction with employer sponsored retirement plans or pre-tax IRAs to maximize your retirement savings.

Roth IRAs are ideal for young investors or those in lower tax brackets who want to diversify their portfolios.

“The flexibility of Roth IRA (or Roth 401(k)/403(b) money as well) allows the withdrawal of funds from Roth accounts in retirement years that have above-average expenses instead of traditional IRA or other accounts that would otherwise push the household into a higher marginal tax bracket.

I wouldn’t say everyone should take advantage of Roth IRAs, as a lot of it comes down to present and expected taxes. There is a case to have a tax-diversified portfolio for retirement with a combination of taxable, tax-deferred, and tax-free sources to draw from regardless of your tax circumstances. Ultimately, this allows for 1) better management of tax brackets in retirement, arguably the largest expense for retirees; and 2) the opportunity to allocate asset classes of a diversified portfolio into the ideal account types.”

Shawn Valco, CFP®, Principal at Balance & Discipline, LLC

A Roth IRA could help you decrease Medicare premiums during retirement by helping you manage your taxable income.

“It is a good idea to have different income sources, and tax-free income at retirement. This is especially important when you retire since your Medicare premium is based on your income. Sometimes, if a retiree withdraws money from their Traditional IRA, that is taxable, it will show up on their taxes as income. This withdrawal causes their taxable income to go up, and then their Medicare premium goes up too!”

The same withdrawal from a post-tax account like a Roth IRA, won’t impact taxable income.

Jill Gleba, Wealth Manager and Founder of Gleba & Associates

Non-Retirement Account Investments Like Stocks, Bonds and Estates: Retirement accounts, like those described above, are considered qualified accounts because they come with pre-tax benefits and governing limitations. However, you may decide to supplement a Solo 401(k), IRA or Roth account with additional investments.

Depending on your level of comfort with investing, you may want to consult a financial advisor or use an investment app that chooses a portfolio for you based on your desired level of risk. Remember, this type of investment is done post-tax and can be riskier than more conservative retirement accounts.

Social Security, SSI and SSDI

Anyone who pays taxes in the United States, and has earned enough work credits to qualify, can receive social security benefits when they turn 67. You must have a minimum of 40 credits to receive benefits and the amount of your benefits increases along with your work credit earned.

For example: As of 2020, you receive one work credit for every $1,410 earned. Anyone born in 1929 or later needs 40 credits to be eligible for retirement benefits. You can earn a maximum of four credits per year, so it would take a minimum of 10 years of work to become eligible for your benefits.

Retirement savings may interfere with public assistance programs such as SNAP, TANF, and Medicaid due to means tests. Some states enforce these resource tests to disqualify individuals with more than a modest amount of assets from qualifying for benefits.

Retirement savings may interfere with public assistance eligibility but it depends on your state asset limits.

“Some states, such as Ohio, Alabama, and Maryland, have removed resource tests entirely from their public benefits programs, so individuals in those states can save freely without fear of losing their benefits.

Most states which enforce resource tests exclude retirement accounts such as IRAs and 401(k)s, but count savings inside of a bank account or taxable investment account. Individuals in these states should make strategic decisions to make sure they are building savings for retirement without running afoul of the rules.

Some states like Kansas and Missouri disincentivize low-income individuals from saving into retirement accounts like IRAs, 401(k)s, or both by counting retirement savings against individuals receiving benefits under certain circumstances, so that they could potentially lose their benefits by using these accounts.”

Ben Dobler, CFP®, EA Financial Coach, Stewardship Financial Counsel

Collecting Social Security and Retirement Savings

When you retire, you can collect both Social Security retirement benefits and distributions from your 401(k), IRA or Roth IRA simultaneously. The amount of money you’ve saved in your retirement account won’t impact your monthly Social Security benefits, since this is considered non-wage income. However, since your Social Security benefits increase if you delay retirement, it may be beneficial to rely on 401(k) distributions in the early years of retirement before you start taking Social Security.

SSI and Disability Benefits

If you recieve Supplemental Security Insurance, or SSI, Social Security benefits due to low income and disability or age are limited to $2,000 in countable assets, including retirement accounts, to continue to receive benefits.

Individuals who become disabled in adulthood are eligible to begin receiving SSDI Benefits before retirement age, provided you meet the disability benefit requirements. Fortunately, there is no asset test.

Disabled individuals can save in special ABLE accounts to avoid resource test limitations.

“Disabled individuals receiving SSI benefits should consider establishing an ABLE account in their state, which can hold up to $100,000 in savings without counting against the resource limit for their benefits.”

Ben Dobler, CFP®, EA Financial Coach, Stewardship Financial Counsel

Retirement Savings and Financial Hardship

Unfortunately, unforeseen circumstances like a layoff, personal health crisis or public health events like the COVID-19 pandemic can interrupt your retirement savings.

In order to prevent events like these from causing a major disruption to your finances and savings goals, we recommend building an emergency fund. In the event of an emergency, you want to avoid dipping into your retirement savings account. Doing so can result in penalties that would take money away from your retirement nest egg.

If you’re dealing with substantial personal debt, consider these tips to determine if you should save for retirement while managing your debt.