When Kate, a wedding planner from Topeka, says, “I’ve had my fair share of financial struggles that nearly tore my family apart,” she was voicing a painful truth many couples face.

Debt can be a silent killer in relationships. It’s not just about the money; it’s about trust, communication, and shared goals. If you’re financially insecure and experiencing stress and anxiety due to debt, it’s crucial to address these debt and relationship issues head-on to protect your partnership.

Debt and Relationship Issues

For many couples, the debt caused by financial stress can amplify existing problems. For example, couples that struggle with communication, trust, or decision-making may find that financial issues are a significant trigger that impacts their relationship quality.

Debt Can Significantly Impact Relationship Quality

Data shows that financial problems, particularly debt, play a pivotal role in relationship quality. They reveal that a significant portion of couples begin their journey with financial burdens and that how debt-related issues are managed can strongly influence the stability and happiness of a partnership.

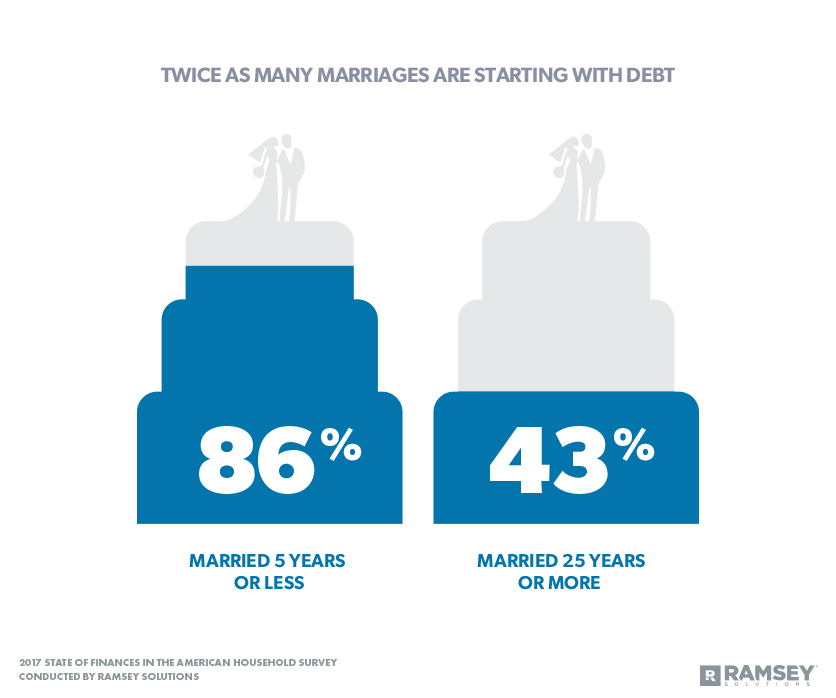

1. Debt at the Start: According to a study by Ramsay Solutions, a staggering 86% of couples who tied the knot from 2016 through 2021 began their journey with debt. This alarming statistic underscores that financial obligations are a prevalent factor in relationships, significantly increasing the likelihood of money-related conflicts for couples with a higher debt burden.

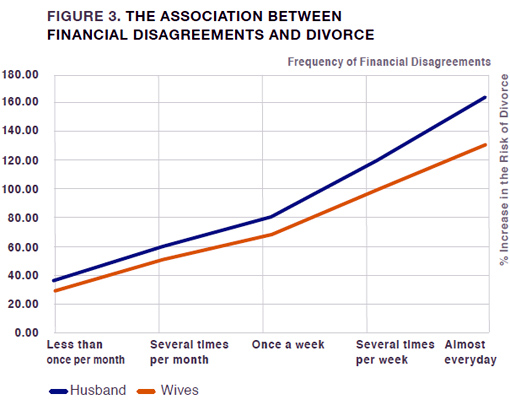

2. Fighting Over Finances: According to studies reviewed by MarketWatch, fighting about money is a top predictor of divorce. This underscores the significant impact that financial disagreements, including debt and relationship issues, can have on a relationship, potentially leading to its dissolution.

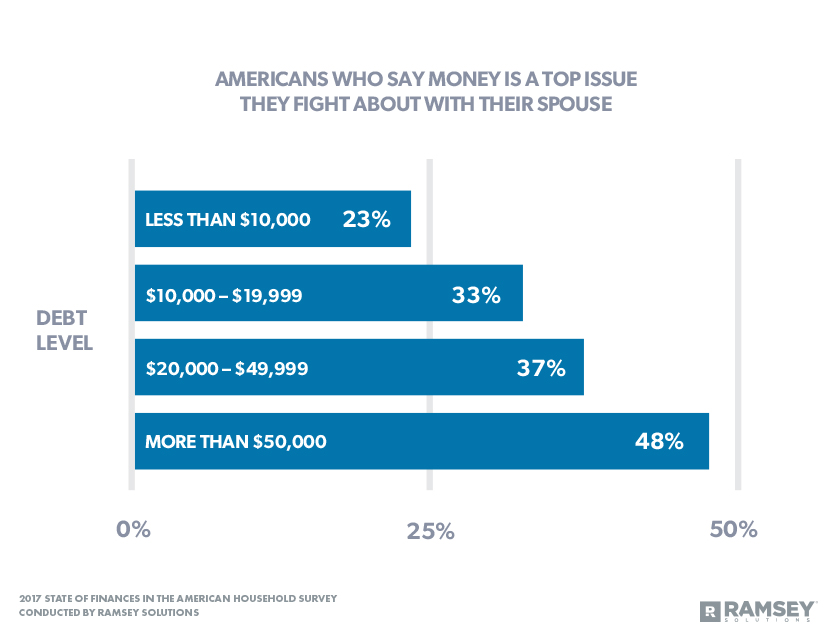

3. More Money, More Fighting: The Ramsay Solutions study also found that the higher the debt, the more likely a couple is to fight about it.

4. Debt as a Reason for Divorce: According to the Jimenez Law Firm, it’s estimated that financial problems contribute to 20-40% of all divorces. This means that a substantial number of marriages end due to debt and relationship issues. Typically, around 41% of divorced Gen Xers, along with 29% of divorced Boomers, state that the reason their marriages ended was due to financial disagreements.

Debt Stress Can Lead to Isolation and Poor Communication

When couples dealing with debt stress isolate themselves or stop talking about money, it can significantly impact their relationships. The isolation effect is a natural response to the overwhelming pressure of debt, but it can exacerbate the problem. Instead of facing the issue together, partners may withdraw emotionally and physically, leading to a breakdown in their connection and trust.

How to Move Forward Together

The first step in addressing debt as a couple is open communication. It’s important to discuss your financial situation honestly and openly. This includes sharing information about your income, expenses, and any outstanding debts.

Communication is Key

Sam Holmes, a seasoned relationship counselor and editor of Feel and Thrive, emphasizes the role of financial challenges, like debt, in straining relationships. Drawing on his experience and expertise in psychology, he recommends couples communicate honestly about their financial situation and develop a plan together to tackle debt.

He also suggests seeking guidance from a financial advisor. To prevent future debt, Sam recommends establishing clear financial boundaries, creating a budget, saving, and setting up an emergency fund. He underscores the importance of emotional resilience and mutual support in overcoming debt-related challenges.

Overcoming debt is not just about money; it’s also about emotional resilience and support. With patience, communication, and a shared commitment to financial well-being, many couples can emerge from the shadow of debt with a stronger, more resilient relationship.

– Sam Holmes, Relationship Counselor, and Editor of Feel and Thrive

Establish Shared Financial Goals

Decide what financial goals you want to work on together. This could include paying off debt, saving for a house, or planning for retirement. Approaching goals together can help you stay focused and motivated to achieve them.

Set Financial Boundaries

Agree on spending limits and discuss larger purchases together, even if you keep your bank accounts separate. Regularly review your finances and adjust plans as needed. It’s a good idea to have personal spending allowances to maintain individual financial independence and reduce conflicts over discretionary expenses.

4 Ways to Get Out of Debt As a Couple

There are several strategies you can use to get out of debt as a couple:

- Budgeting: This involves tracking your income and expenses and setting aside money to pay off your debt.

- Debt Snowball Method: This involves paying off your smallest debts first to gain momentum before tackling larger ones.

- Debt Avalanche Method: This involves paying off debts with the highest interest rates first to save money over time.

- Debt Consolidation: This is a process where Consolidation Specialists help you make a plan to get out of debt.

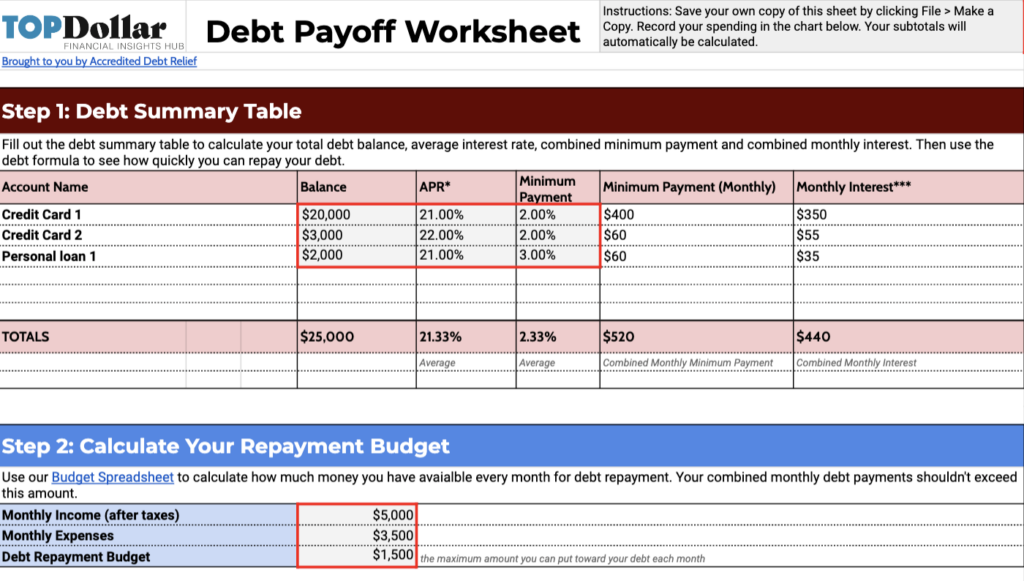

Free Debt Payoff Worksheet

Download your copy of the worksheet to estimate how much money to put toward your debt each month and how long it will take to pay off.

A Wedding Planner’s Debt Almost Ruined Her Marriage – Budgeting and Open Communication Saved It

For Kate, a 35-year-old wedding planner from Topeka, KS, her dream of starting a business brought with it a daunting amount of debt. When the pandemic began, Kate’s business stopped overnight, and suddenly, the debt she had accumulated to pursue her dream was unmanageable.

I’ve had my fair share of financial struggles that nearly tore my family apart. As a wedding planner, I accrued substantial debt in pursuit of my dream business. However, the COVID-19 pandemic exacerbated our financial woes when weddings became a rarity.

-Kate, Wedding Planner and Founder of Bridilly

Instead of choosing consolidation loans or bankruptcy, she and her husband strategically tackled their debt by creating a strict budget, cutting non-essential expenses, and emphasizing financial transparency and communication.

Their determination allowed them to salvage their relationship and secure their financial future as their business recovered.

Through sheer determination, we not only salvaged our relationship but also our financial future… We now actively protect ourselves against future debt burdens by maintaining a robust emergency fund and prudent financial planning.”

Kate, Wedding Planner and Founder of Bridilly

This experience has led her to advocate for open communication, careful budgeting, and a commitment to financial responsibility as powerful tools for overcoming the strain debt can put on relationships.

Kate’s story is a testament to the fact that while debt can indeed strain marriages, it’s possible to rise above it with resilience, strategic planning, and a commitment to financial responsibility.

When a husband and wife can eliminate debt, a shift happens in their marriage. There’s a peace of mind they haven’t experienced before.

Rachel Cruze, #1 New York Times best-selling author and personal finance expert

A Teacher Navigated Debt and Marital Stress During a Pandemic with Debt Consolidation to Guide Her Way

Erin, a working mother, schoolteacher, and the primary breadwinner of her family, found herself in a debilitating debt situation when her husband lost his job during the pandemic. With expenses mounting and an income shortfall, Erin’s credit card debt spiraled from a manageable $3,500 to a staggering $38,000.

Minimum payments further compounded her financial troubles, causing a significant strain on her relationship with her husband.

[My debt was] debilitating. I thought, how am I going to do this? I have two kids. I have to pay for daycare. I’m living paycheck to paycheck already.

Erin, Mom, Schoolteacher, and Debt Consolidation Client

Desperate for a solution, Erin discovered Accredited Debt Relief and started working with Beyond Finance. It was a decision that soon proved transformative for her debt and marriage stress!

Within three months of enrolling with Beyond Finance, Erin saved an impressive $14,000 on one of her debts. Her monthly deposit was reduced to $298, a far cry from the $1,200 minimum payments she previously shouldered.* Beyond Finance helped her follow a plan to get out of debt, eliminating the need for Erin to remember to make the payments.

Within three months, I already saved $14,000.

Erin, Mom, Schoolteacher and Debt Consolidation Client

Beyond Finance provided Erin with the financial relief she desperately needed, helping to alleviate her anxiety and repair the strain on her marriage. The experience underscores the power of debt consolidation and how it can help you deal with debt and restore peace and stability to familial relationships.

*Erin was interviewed in 2022 about her experience with Accredited Debt Relief and Beyond Finance and was compensated for her time. Results vary based on individual client experience, and this example is not representative of results in all cases.

How to Seek Professional Help with Your Debt

If you and your partner struggle to manage your debt, it may be time to seek professional help. Talking to a Consolidation Specialist can help you determine how much you could save on your monthly payments and estimate how much you could save work with a debt consolidation service.

Fill out a short form and talk to a Consolidation Specialist now!