Setting goals is often easier said than done, especially when finances are involved. We would all like to make more money, pay off debt, start investing or make a big purchase. However, knowing how exactly to bring those wishes to life can be tricky.

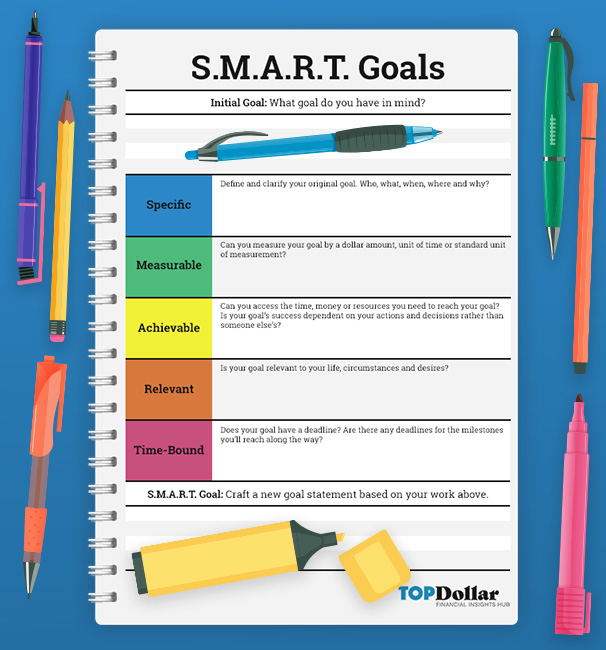

A great way to set your goals up for success is to structure them using the S.M.A.R.T. system. By closely analyzing what you want and the steps you’ll need to take to get there, you can create clear and actionable goals worth working toward.

What Is a S.M.A.R.T. Goal?

S.M.A.R.T. is a tool used to set clear and actionable goals. This mnemonic acronym is especially popular for building and improving goals related to project management, employee performance and self development.

S.M.A.R.T. first appeared in a 1981 article of Management Review by George T. Doran. While the original words that the acronym represented have changed over time, S.M.A.R.T. continues to help goal-setters focus on what they want to accomplish and how to best reach their final goal.

The most common S.M.A.R.T. breakdown is as follows:

S is for SPECIFIC

Clear and defined statements promote action better than vague ones. Make your goal specific by asking yourself the “5 W’s” – who, what, when, where and why.

| Less Specific | More Specific |

| I want to improve my cholesterol. | I want to make specific lifestyle changes so that my cholesterol levels will have improved by my next doctor’s appointment. I want to start with adding more heart-healthy foods to my diet, and I want to start exercising four times a week. |

M is for MEASURABLE

Creating measurable goals can help you reach deadlines, review your progress and stay on track. Can you measure your goal by a dollar amount, a unit of time or a standard unit of measurement?

| Less Measurable | More Measurable |

| Our goal is to save more money to put towards a vacation. | Our goal is to raise $3,000 to put towards our vacation next July. |

A is for ACHIEVABLE

In order to experience success, your goal should be realistic and attainable based on your actions. Can you access the time, money or resources you need to reach your goal?

One common pitfall is focusing on goals that are out of your control. For example, you might want to secure a new job. While you can do many things to increase the likelihood that you’ll be seen as the top candidate, the recruiter or hiring manager will ultimately be in control of the final decision. In this case, you’ll want to reword your goal so that it focuses on what you can do to make yourself a more favorable candidate.

| Harder to Achieve | Easier to Achieve |

| I want to get a new job with a specific company. | I want to gain the proper skills and training, rewrite my cover letter and resume, and brush up on my interview skills. I want to do all of these things so that I can become a competitive candidate for the new job that I want. |

R is for RELEVANT

Our hopes, dreams and goals change over time based on our environment and our personal growth. That’s perfectly okay!

Be sure to evaluate whether your goal is appropriate for your short and long term plans. This way, you can still set achievable goals without feeling limited by your current circumstances. Additionally, if circumstances change and you come across an amazing opportunity, you can adjust your goals again!

| Less Relevant | More Relevant |

| My goal is to backpack across Europe for three months. | Due to the current pandemic, it’s not possible to travel overseas. I will adjust my goals so that they’re more relevant to my current circumstances. My new goals are to save $5,000 more for my travel fund, make preparations for when it’s safe to travel again, and take one or two socially distanced weekend trips within my state in the next six months. |

T is for TIME-BOUND

Without a deadline, it’s easy to become lazy or lose focus on your goals. Setting a target date for the completion of your goal, as well as any relevant milestones, can help you stay on track.

| Not Time-Bound | Time-Bound |

| I eventually want to get my MBA. | I want to start an MBA program next year. I will research the application process and make a list of my top 5 schools by the end of this month. I will start studying so that I can take my standardized tests in six months. I will submit my applications in eight months. |

Making S.M.A.R.T. Financial Goals

The S.M.A.R.T. system can be incredibly helpful when it comes to planning for your financial future. Here are some examples we’re created to inspire your next money-related goal:

Specific: I want to save enough money to make a healthy down payment on a new sedan. I plan on using it for both work and recreational travel. I want to make this purchase in the next 10 months.

Measurable: I want to save $10,000 to put towards my vehicle purchase. I will put $500 from each paycheck into my new car fund to achieve this goal.

Achievable: I don’t have the money to make this purchase immediately. However, based on my current income and my financial commitments, I can reasonably afford to save up for this purchase over the next 10 months.

Relevant: I would love to buy a new convertible or a sports car, but these vehicles are more than I can afford. They’re also less practical for my needs. A sedan is the most practical option for me at this time.

Time-Bound: My goal is to save $10,000 in the next 10 months to put towards my new car. If I consistently put $500 from each paycheck into my new car fund, I can reach this goal by my deadline.

Specific: I want to pay off my three credit cards, my medical debt and my student loans in the next five years. I want to accomplish this so I can put my money towards my other financial goals in the future.

Measurable: I will adjust my monthly budget so that I can put $1,000 a month towards paying down my debts. I will focus on paying off my smallest credit card debt first, which I should be able to do within the next three months.

Achievable: I don’t currently make enough to pay off my debt by my deadline. To make this more achievable, I will cut out all unnecessary spending and take on a side job. I will also research my debt consolidation options and incorporate one if it can help me reach my goal faster.

Relevant: Becoming debt-free will allow me to put my future earnings towards the things that matter most to me. It makes sense to prioritize paying off my debt so that I can save for a new car or home in the future.

Time-Bound: I would like to pay off my debts within the next five years. I will pay off my smallest credit card debt in three months. I’ll pay off my medical debt in 11 months. I’ll finish paying off my student loans in five years.

Specific: I need to create an emergency fund that I can rely on in case I’m faced with an unexpected expense in the future. I will store it in a separate, designated savings account so that I’m not tempted to “dip” into these funds for everyday purchases.

Measurable: I will start with the initial goal of saving $1,000 for this fund. Once I’ve reached this goal, I’ll continue saving enough to cover six months of my living expenses, which is about $9,000.

Achievable: I set the initial goal of $1,000 because that is easier for me to achieve in a short amount of time. Working up to $9,000 will take more effort, but I can achieve this goal if I take on some side work and consistently put money towards my emergency fund.

Relevant: Emergencies can happen at any time, so having an emergency fund to rely on in a pinch is a huge priority for me.

Time-Bound: I should have a nest egg of savings as soon as possible, so I’m pushing myself to save $1,000 over the next three months. After that, I’ll commit to putting at least $300 from each paycheck, as well as any bonuses or tax refunds I receive, towards my $9,000 goal. I’m challenging myself to meet this goal within two years.

Make S.M.A.R.T. Goals With Our Template

We’ve created a free downloadable and printable PDF to help you create your own S.M.A.R.T. goals. Get started by clicking the image below.

For more help with accomplishing your financial goals, take a look at some of our best goal-oriented blogs:

- Create a budget with our free template.

- Repair your credit score with these good habits.

- Learn more about emergency funds and why you should have one.